Account is subject to application, eligibility, credit check and T&Cs.

HSBC Financing for Growth report

Discover how ambitious UK businesses are turning uncertainty to action in our HSBC Financing for Growth report

Big Support for Small Businesses

Behind every small business is a story worth sharing. Click to read about some of the businesses we're proud to support.

Need a personal account? Make it Premier

HSBC Premier is our premium personal banking account that gives you more than banking with wealth, health and travel benefits, and rewards too.

Qualify for Premier with £100,000 individual annual income paid into your bank account or £100,000 savings or investments with HSBC UK, or Premier status abroad. T&Cs and eligibility criteria applies.

Small Business Growth Programme

Our programme of free insights, events and training gives businesses the tools they need to succeed.

*Android and Google Play are trademarks of Google Inc. Apple, iPhone, Touch ID and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Google Pay and Google Wallet are trademarks of Google LLC

Samsung Pay and Samsung Wallet are trademarks of Samsung Electronics Co. Ltd.

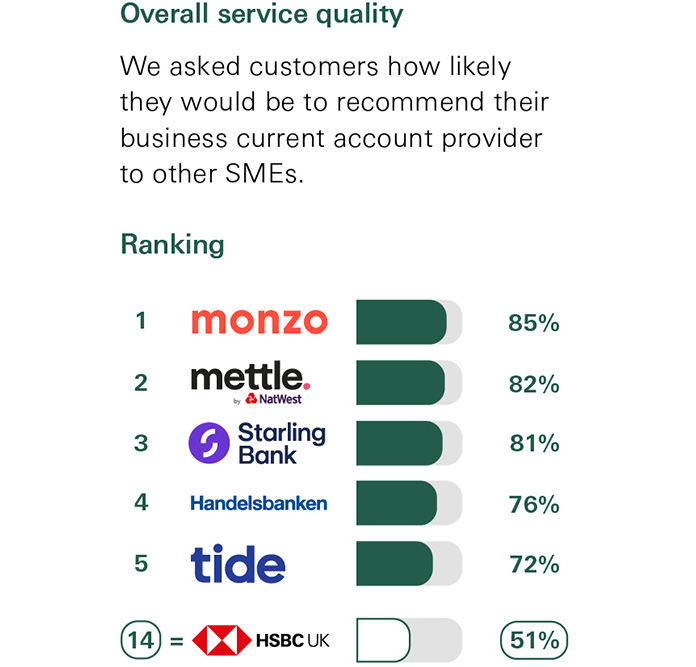

Award winning business banking

Independent service quality survey results

Access to Cash

You can use our HSBC branches, Post Office® branches, Banking Hubs and Multi-Bank ATMs for cash services including deposits and withdrawals across the UK.

Find out more

Subject to application, eligibility, credit check and T&CS.

¹ Free UK digital banking means day-to-day standard electronic transfers made through Business Internet Banking and HSBC UK Business Banking app are free. Other charges apply e.g. cheques and CHAPS. See Business Price List for details. Subject to application, eligibility, credit check and T&Cs.

Your eligible deposits held by a UK establishment of HSBC UK Bank plc are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme. This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc, HSBC Private Banking, and first direct. Any total deposits you hold above the limit between these brands are unlikely to be covered.

Please click here for further information or visit www.fscs.org.uk.