Help with everyday business banking

Small Business Growth Programme

Our programme of free insights, events and training gives businesses the tools they need to succeed.

Business Banking that works for you

Convenient tools, greater control and easy self-service for your Business Internet Banking

Award winning business banking

Euromoney UK’s Best Bank

Voted the UK’s Best Bank in 2024.

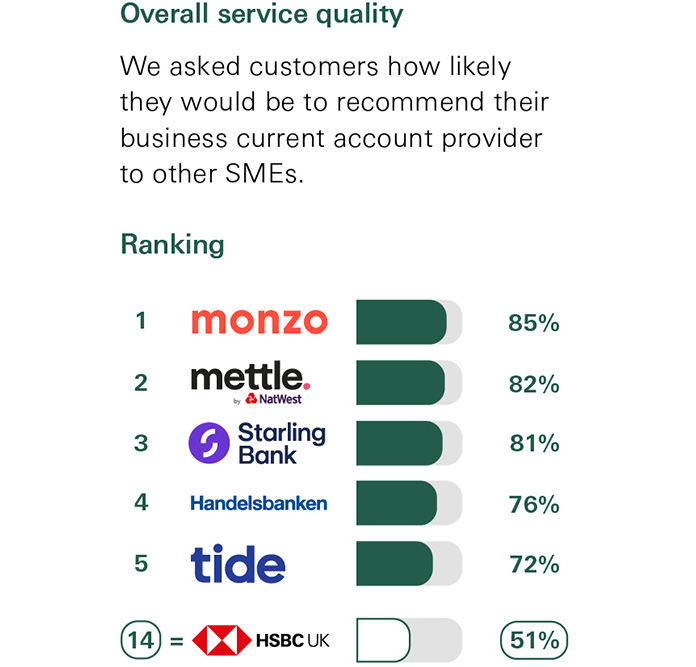

Independent service quality survey results

Access to Cash

You can use our HSBC branches, Post Office® branches, Banking Hubs and Multi-Bank ATMs for cash services including deposits and withdrawals across the UK.

Find out more

Subject to application, eligibility, credit check and T&CS.

¹ You must be an HSBC Business Banking customer to access free accounting tools through My Business Finances. Once you’ve opened your Account, you’ll need to set up Business Internet Banking to get access.This is not available for HSBC Kinetic customers. T&Cs apply. Find out more here

² Free UK digital banking means day-to-day standard electronic transfers made through Business Internet Banking and HSBC UK Business Banking app are free. Other charges apply e.g. cheques and CHAPS. See Business Price List for details. Subject to application, eligibility, credit check and T&Cs.