HSBC takes the lead in helping UK SMEs seize international growth...

Article

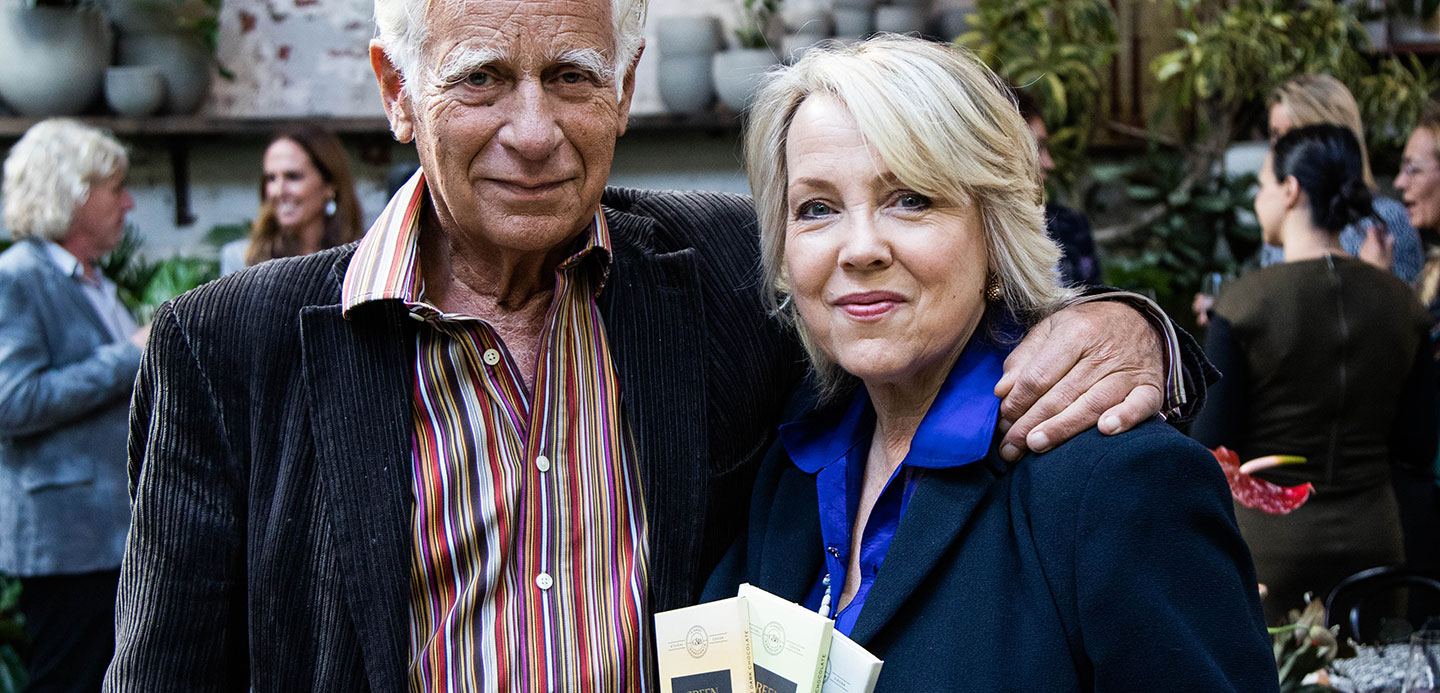

Ooni’s co-founder Darina Garland shares five key insights on how the brand was taken from home expe...

We can help you get your business started, and support you as your business grows. Access and manage your money with a range of business accounts, a business savings account and a business credit card.