Money Worries

Back to Wellbeing: Business and IndividualOne in 4

business owners said their financial situation had negatively impacted their personal wellbeing

29%

A third of business owners have used their own personal savings to fund their business

55%

Over half of businesses have not turned to anyone – even friends or family – about how their business has been affected.

52%

Over half would prefer to do research online instead of speak to someone.

We have a range of resources and tools to support you, what would you like to do today?

Managing your business finances

Cash Flow Forecasting

Managing and forecasting cash flow is key to every business, Discover how to optimise your cash flow.

Online money management tools

Being able to see your accounts at a point in time which suits you is key to managing your business finances. Explore the different ways to bank with us:

Other sources of Support

Deciding whether to borrow? Wanting to put together a powerful business plan? Wherever you are on your journey, expert financial support could really benefit your business.

How Financially Fit are you?

Knowing how healthy your personal finances are can help you work out what steps you need to take to achieve your goals.

What to look out for

Be aware of the warning signs which may individually or collectively indicate financial difficulties.

Employee support

We offer a Personal Financial Wellbeing Programme to you or your employees to assist with managing personal finances.

Struggling to keep up with payments or already missed a payment

If you’re experiencing financial difficulty please get in touch with us. If you have a Relationship Manager, please get in touch with them in the first instance, as they will be best placed to provide tailored support for your business.

If you don’t have a Relationship Manager, please call our dedicated Financial Support Team on 0800 085 3955.

Open 08:00 to 18:00 Monday to Friday (except bank holidays) and 08:00 to 16:00 Saturday.

Ahead of contacting us it is important that you consider any problems you have with priority debts, such as energy bills. If you have arrears or debt with multiple companies, you may want to reach out to a debt management charity to arrange a plan. Whilst you work through a plan for your finances with these companies, they can help you arrange some breathing space with us for up to 60 days. If you want us to, we can work with these companies.

When you call, we will ask some questions to understand your businesses income and expenditure. From this we can help build a personalised plan for your business, based on your current affordability and how you expect this to change in the coming months.

If you have a Bounce Back Loan, you can also consider Pay as You Grow options. You can make use of these options online through Business Internet Banking and read more about the options Bounce Back Loan.

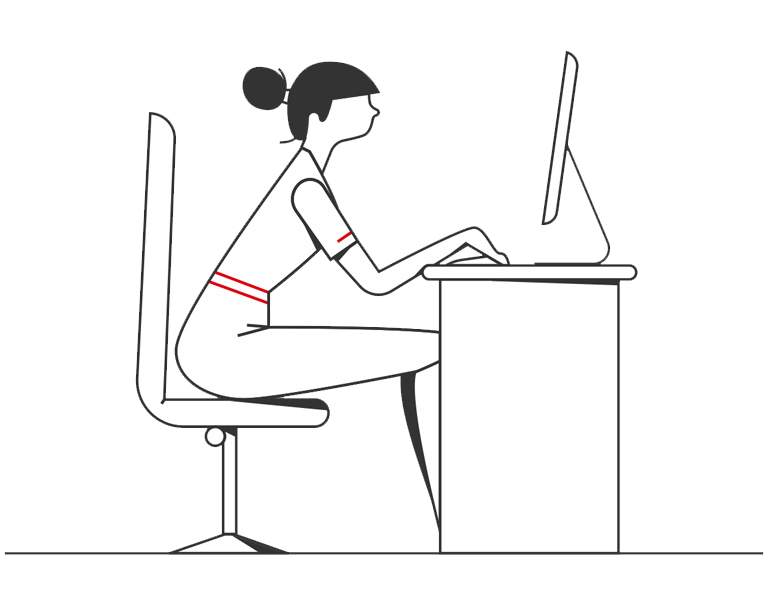

Effects of Financial Difficulty

Financial difficulty and performance issues can affect both your business and individuals within.

Who else can I get advice from?

Prior to contacting HSBC or alongside you can contact other debt counselling and support organisations.

Additional Support Services

These organisations are independent from HSBC and can provide you with support and advice.

Take a look below for details of independent organisations providing business and personal support to see if they can help with advice and practical help.

Wellbeing guide

Help to manage your personal finances

If you’re worried about your personal finances, we have a range of ways we can support you. Take a look at our Money Worries | Support With Your Finances - HSBC UK page to understand how we can help.