*SmartSweep is the first Invoice Discounting tool of its nature to the UK market

Invoice Discounting: Unlock cash from outstanding invoices

At a glance

- Receive up to 95% of the value of your invoices the next working day or sooner

- Manage your own credit control

- Add Credit Protection to guard against late payment or bad debts

- With our market-leading* technology, Global Trade Solutions SmartSweep, there’s no need to ask your buyers to change which bank account they pay into

Key benefits

Improve your cash flow by releasing working capital tied up in unpaid invoices

Daily funding updates in line with your sales ledger

HSBC software connects with your accounts system for easy administration to save you time

Choose how you want your finance: in sterling, euro, US dollars or most other major currencies

Can be used for both export and UK sales

Protect your invoices with our optional Credit Protection service

Is Invoice Discounting right for your business?

Invoice Discounting could meet your needs if:

- Your sales are growing and you want to ensure that your cash flow will keep pace

- You have money tied up in the sales ledger that could be working harder for your business

- You’re funding a major purchase or planning a management buy-out/by-in and want the sales ledger to help fund your working capital needs

- You want the sales ledger to fund your working capital needs

- You want to manage your own credit control

Our Invoice Discounting facility could be suitable for businesses who:

- Sell to other businesses on credit terms

- Have an actual or projected annual business turnover of £1m+

Invoice Discounting is available to businesses that bank elsewhere as well as HSBC business customers. It can be used for international sales as well as UK sales.

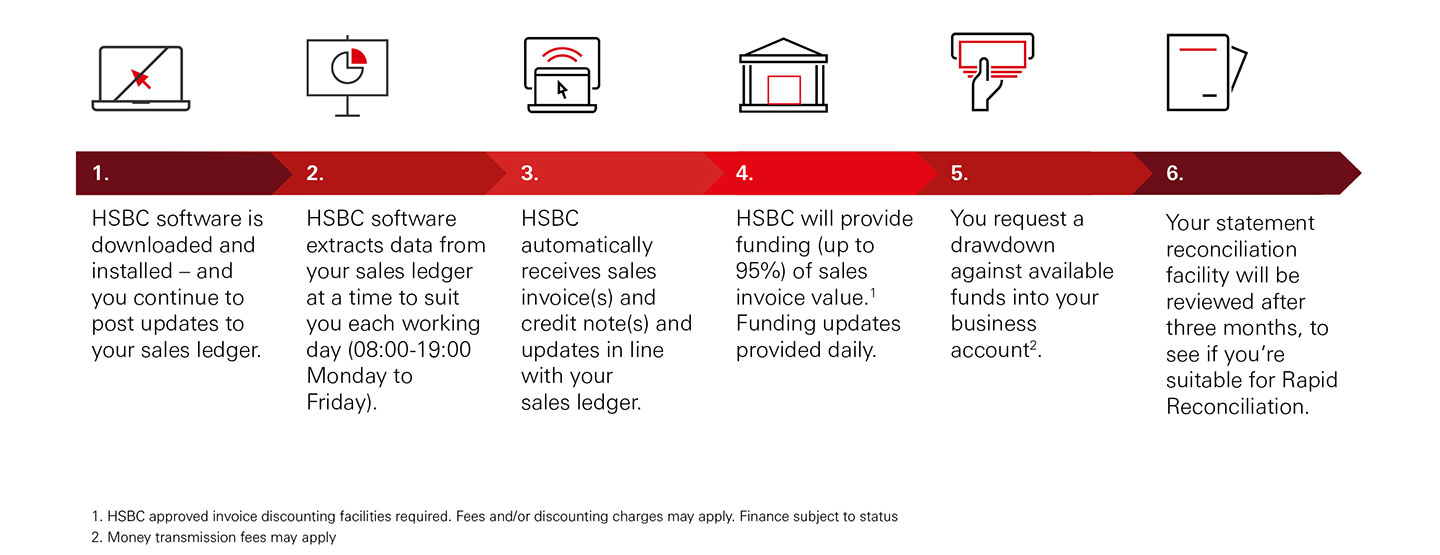

How Invoice Discounting works

Invoice Discounting releases cash from your invoices the same day. Here's a quick overview of how it works:

- You provide the goods/service to your customers and invoice them as usual

- Our digital software integrates with your accounting system* and automatically uploads invoices and credit notes

- We advance up to 95% of your invoices’ value the same day

- You collect payment on our behalf when your invoices fall due

- The SmartSweep technology can automatically sweep your selected buyer payments from your Business Current Account to your HSBC Receivables Finance Trust Account

- We make the remaining balance available, minus our agreed charges

The whole process can be managed online via HSBCnet.

* You can use one of our standard connectors suiting more than 20 popular accounting packages or our Universal Adaptor (CSV) for other bespoke solutions which we will work with you to implement.

** When consenting to buyer sweeping, if a buyer tends to use multiple payment methods, i.e. BACS faster payments, CHAPS, you must consent to each method to ensure all payments are successfully processed.

Our digital in-life journey

Unlocks funding against your unpaid invoices

A digital solution that links directly to your accounts package to automatically upload your sales ledger giving you access to additional working capital.

HSBC integrates with your accounts package via an API connection (Application Programming Interface) or via our connector which is downloaded and installed on your desktop or server to automatically update your ledger.

Important information

Invoice Discounting product guide (PDF, 1.29MB)

Find out more about our Invoice Discounting facility

Credit Protection Guide (PDF, 381KB)

Find out more about our Credit Protection service

Don't have Adobe PDF Reader? Download Adobe Reader