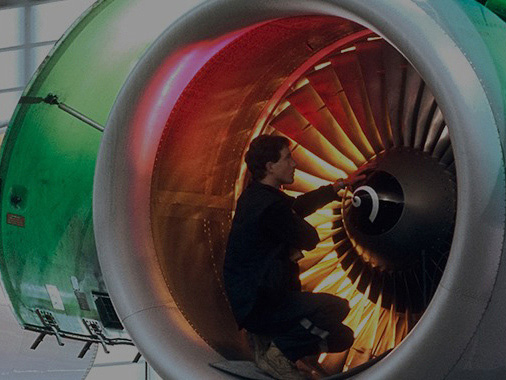

Where you find challenge, we’ll help you harness opportunity. With HSBC UK as your partner, doubts about exploring new markets becomes certainties. Obstacles like access to finance become strategic advantages. And ambitions to scale up or expand become reality.

With our specialist team, global reach and breadth of innovative solutions, we’re equipped and ready to connect you to the opportunities you need in order to reach your aspirations.