- Article

- Support

- Economic Reports

Are trade deficits bad for an economy?

Helping you understand trade deficits, it's importance to the economy and what it could mean for your business.

A trade deficit must be offset by a surplus elsewhere

In typical economist fashion, the answer to whether trade deficits are bad for an economy is: it depends. Globally, while some countries have been able to sustain a trade deficit without cause for concern, others have not. Meanwhile, a trade surplus is not a cause of, or prerequisite to, economic growth and can even suggest a lack of growth opportunities. Therefore it is useful to assess a trade deficit alongside the broader economic environment – what are its drivers and is it sustainable?

A trade deficit means a country is borrowing from overseas to consume. In its simplest form the trade balance should approximately equal the difference between national savings and investment.

Therefore a trade deficit implies savings are insufficient relative to the level of desired investment. Capital inflows meet that shortfall and fills the gap between savings and investment for a given level of real interest. That means a country can borrow externally to fund investment and consumption, and keep interest rates lower than would otherwise be needed to balance savings and investment.

But should we worry about a trade deficit?

If a trade deficit can be sustainably financed by borrowing from abroad, it shouldn’t be problematic. Indeed, the ability to finance investment via capital flows from abroad may signal a country’s growth prospects and attractiveness as a place to invest. Moreover, it also enables a government to respond to shocks, such as a global pandemic, without adverse consequences such as higher interest rates.

The point at which a trade deficit raises concern is if the domestic environment becomes uncompetitive or unstable such that capital flows are not forthcoming. Moreover, the trade deficit helps to enable government borrowing so its relationship to the fiscal deficit is important; often referred to the twin deficit phenomenon whereby the government is either directly or indirectly financing its borrowing from abroad. If the fiscal deficit is persistent due to a lack of savings, such that debt is increasing as a share of GDP, it can signal fiscal irresponsibility. It can be argued that for as long as a country is able to attract capital flows, i.e. run a trade deficit, then a persistent, stable fiscal deficit is manageable. However, if the private sector is being crowded out and growth is low, it risks a loss of confidence that sees the withdrawal of capital.

Therefore, trade deficits aren’t inherently bad. Some economies e.g. the US and UK have benefitted from an ability to save little and consume a lot, and manage a trade deficits, others such as Argentina have not. Generally, the ability to sustain a trade deficit is aided by various factors including: a flexible exchange rate regime, diverse exports, strong financial sector, coherent fiscal and monetary policy, and economic growth and stability. Some trade deficits (or trade surpluses) are temporary while some are persistent, but ultimately it depends on the broader economic trends to determines whether it’s a cause for concern.

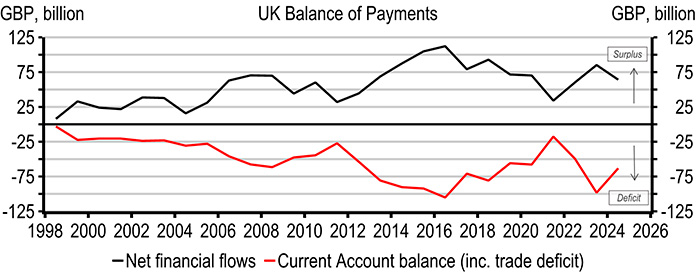

The UK has run a trade deficit persistently that has been offset by a surplus in financial flows

1In this simple example, we consider the trade component of the current account, which also includes ‘primary income’ such as investment income and ‘secondary income’ such as remittances, foreign aid and contributions to international organisations

Important disclosures

Additional disclosures

- This report is dated as at 09 October 2025.

- All market data included in this report are dated as at close 08 October 2025, unless a different date and/or a specific time of day is indicated in the report.

HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. - Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

Africa:

1 In South Africa, this publication is distributed through HBEU’s registered branch in South Africa being HSBC Bank plc Johannesburg Branch, Registration Number 2003/004613/10 (Financial Services Provider Number: 43940) of 1 Mutual Place, 107 Rivonia Road, Sandton, 2196.

Americas:

1 In Bermuda, this publication is distributed by HSBC Bank Bermuda Limited of 37 Front Street, Hamilton, Bermuda, which is licensed to conduct Banking and Investment Business by the Bermuda Monetary Authority. 2 In the United States, this document is distributed by HSBC Securities (USA) Inc. ("HSI") to its customers. HSI is a member of the HSBC Group, the NYSE and FINRA.

Asia Pacific:

1 In Australia, this publication has been distributed by HSBC Bank Australia Limited (ABN 48 006434 162, AFSL No. 232595) only, for the general information of its clients. Any reference in this publication to other HSBC Group entities shall not be taken to mean that such entities has a presence in or are licensed in Australia, or that such entities are offering to do business and/or enter into transactions with persons located in Australia. 2 In Bangladesh, this publication is distributed by The Hongkong and Shanghai Banking Corporation Limited (“HBAP”), Bangladesh branch. 3 In mainland China, this publication is distributed by HSBC Bank (China) Company Limited (“HBCN”) to its customers. 4 In Hong Kong, this publication is distributed by HBAP to its customers for general reference and information purposes only. 5 In India, this publication is distributed by HBAP, India branch, to its customers for general reference and information purposes only. 6 In New Zealand, this publication is distributed by HBAP, incorporated in the Hong Kong SAR, acting through its New Zealand branch. 7 In Singapore, this publication is distributed by HBAP, Singapore branch (“HBAP, Singapore branch”) to institutional investors or other persons specified in Sections 274 and 304 of the Securities and Futures Act (Chapter 289) (“SFA”) and accredited investors and other persons in accordance with the conditions specified in Sections 275 and 305 of the SFA. For recipients which are not institutional investors, accredited investors or expert investors as defined in the SFA, this is distributed pursuant to Regulation 32C of the Financial Advisers Regulations (“FAR”). HBAP, Singapore branch, accepts legal responsibility for the contents of the publication pursuant to Regulation 32C(1)(d) of the FAR. This publication is not a prospectus as defined in the SFA. HBAP, Singapore branch, is regulated by the Monetary Authority of Singapore. Recipients should contact an HBAP, Singapore branch representative in respect of any matters arising from or in connection with this publication and refer to the contact details at www.business.hsbc.com.sg. 8 In Sri Lanka, this publication is distributed by HBAP, Sri Lanka branch to its customers. 9 In Malaysia, this publication is distributed by HSBC Bank Malaysia Berhad (“HSBC Malaysia”) to its clients for general reference and information purpose only, and do not constitute any advice, recommendation or offer by HSBC Malaysia. Therefore, this should not be considered as communicating any invitation or inducement to engage in banking or investment activity or any offer to buy or sell any securities or instruments to its clients. Further, HSBC Malaysia does not make any representation or warranty of any nature, and does not accept responsibility or liability for any errors or omissions. HSBC Malaysia shall not be liable for any damage, loss or liability arising out of or in connection with your use of or reliance on this publication.

Europe:

1 For clients of HSBC Continental Europe and HSBC Continental Europe branches, this publication is distributed by HSBC Continental Europe. HSBC Continental Europe is an « Etablissement de crédit et prestataire de services d’investissement» authorized by the « Autorité de Contrôle Prudentiel et de Résolution » (ACPR) and the European Central Bank (ECB). It is regulated by the « Autorité des Marchés Financiers » (AMF), the ACPR and the ECB. 2 In Malta, this publication is distributed by HBEU and is being made accessible to customers of HSBC Bank Malta p.l.c. (“HBMT”). HBMT is registered in Malta with company number C-3177 and is licenced to conduct investment business by the Malta Financial Services Authority. 3 In Switzerland this publication is distributed by HBEU to its customers. 4 In the UK and CIIOM, this publication is distributed by HBEU to its customers and by HSBC Bank UK plc (“HBUK”) to its customers. HBEU is registered in England and Wales (company number: 14259), registered office: 8 Canada Square, London, E14 5HQ, UK. HBUK is registered in England and Wales (company number: 09928412), registered office: 1 Centenary Square, Birmingham B1 1HQ, UK. HBEU is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 114216). HBUK is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 765112).

Middle East:

1 In Algeria, Bahrain, Kuwait, Qatar, the United Arab Emirates (the “UAE”) and the Dubai International Financial Centre (the “DIFC”), this publication is distributed by HSBC Bank Middle East Limited (“HBME”) to its customers. HBME is registered in the DIFC with company registration number 2199 and its registered office at Level 1, Building No. 8, Gate Village, DIFC, PO Box 66, Dubai, DIFC and is lead regulated by the Dubai Financial Services Authority. HBME operates in Algeria through its Algeria branch at Algeria Business Center, Pins Maritimes, El Mohammadia, 16212 Algiers, Algeria (commercial licence number: 07 C 0974997), which is regulated by the Central Bank of Algeria (Banque d’Algérie) and lead regulated by the DFSA. HBME operates in Bahrain through its branch at PO Box 57, Building 2505, Road 2832, Seef 428, Manama, Kingdom of Bahrain (commercial registration number 330-1), which is regulated by the Central Bank of Bahrain and lead regulated by the DFSA. HBME operates in Kuwait through its branch at Kharafi Tower, Qibla Area, Hamad Al-Saqr Street, PO Box 1683, Safat 13017, Kuwait (Ministry of Commerce and Industry branch licence number SP2005/4), which is regulated by the Central Bank of Kuwait, the Capital Markets Authority for licenced Securities Activities and lead regulated by the DFSA. HBME operates in Qatar through its branch at PO Box 57, Doha, Qatar (trade licence number 6374), which is regulated by the Qatar Central Bank and lead regulated by the DFSA. HBME operates in Dubai through its branch at HSBC Tower, Downtown, PO Box 66, Dubai, UAE (Chamber of Commerce and Industry branch licence number 617987), which is regulated by the Central Bank of the UAE and lead regulated by the DFSA. 2 In Egypt, this publication is distributed by HSBC Bank Egypt SAE to its customers. HSBC Bank SAE is registered in Egypt (commercial registration number: 218992) with registered office: 306 Cornish El Niel, HSBC Bank Egypt SAE, Maadi, Cairo, Egypt. Regulated by the Central Bank of Egypt. 3 In Turkey, this publication is distributed by HSBC Bank A.S. to its customers. HSBC Bank A.S. is registered in Turkey (commercial register number 268376) with registered office: Esentepe Mah. Büyükdere Cad. No. 128, Şişli 34394, Istanbul, Turkey. Regulated by the Banking Regulatory and Supervisory Agency. 4 In Oman, this publication is distributed by HSBC Bank Oman SAOG to its customers. HSBC Bank Oman SAOG is registered in Oman (commercial registration number: 1/08084/9) with registered office: Head Office Building, PO Box 1727, Seeb, PC 111, Sultanate of Oman. Regulated by the Central Bank of Oman and the Capital Market Authority of Oman. 5 In the Kingdom of Saudi Arabia, this publication is distributed by The Saudi British Bank to its customers. The Saudi British Bank is registered in the Kingdom of Saudi Arabia (commercial registration number: 1010025779), registered office: Head Office, PO Box 9084, Riyadh 11413, Kingdom of Saudi Arabia. Regulated by the Saudi Arabian Monetary Authority.

© Copyright 2025. HSBC Bank plc, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, whether electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of HSBC Bank plc.