Business Banking eligibility criteria apply*

Business Banking Account

Open your Business Banking Account

Free banking for 12 months – all electronic payments are free *

Visa Commercial Card available - no annual fee for the first year. Representative example: based on an assumed limit of £1,200, 15.9% rate p.a. for purchases, 22% APR representative variable. Annual Fee £32**

Overdraft available***

Use the HSBC UK Business Banking app to scan and deposit cheques****

*Free banking means no account maintenance fee and free standard transactions on your primary account, any additional or secondary accounts will be charged in line with the Business Banking Account.

**After the initial 12 month period, the annual fee for each Commercial Card is only £32. Commercial Cards are available for you and your employees (subject to status).

***Arranged overdraft available subject to status and application.

****You can deposit any number of cheques daily via the app up to a maximum of £5,000. Individually, none can exceed £2,000.

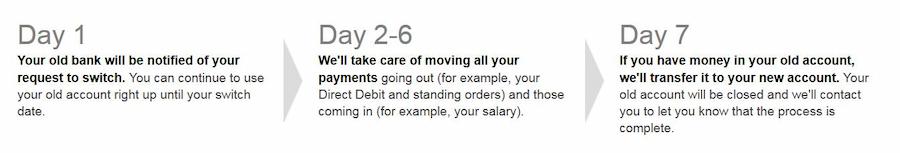

Effortless switching

- We’ll contact your old bank to let them know you’re switching

- We’ll transfer your balance and any automated payments for you

- We’ll close your old account on the date you’ve chosen

Good to know

Any payments accidentally made to your old bank will automatically be redirected to your new account. We’ll also give your new details to people paying your old account. And if anything goes wrong, we’ll refund you for any interest or charges incurred.

Helping your business thrive

Mobile business banking

Bank on the go with our app

Run your business from the palm of your hand. Make payments, view balances and transactions, and manage Standing Orders and Direct Debits. Scan and instantly deposit cheques securely, and block or unblock your debit and credit cards to save you time. Device restrictions may apply.

Business loans and overdrafts

Achieve your ambitions

We offer a range of lending options to help you grow your business**

Commercial and Corporate cards available

Commercial Card, to help you keep control of your day-to-day spending, boost your cash flow and fully protect your transactions against fraud.

Credit is subject to status. Representative example: based on an assumed limit of £1,200, 15.9% rate p.a. for purchases, 22% APR representative variable. Annual Fee £32.

Corporate Card, a flexible solution for larger businesses with an annual turnover of above £2m, to help you keep control of your company’s expenses and purchasing- also available in euros.

International payments

International payments for over 60 currencies

Starting from just £17*

Simplify foreign exchanges

Foreign currency accounts available in most international currencies, account charges apply.

Visa Business Debit Card available

Manage your expenses

Business Debit Cards are available on request to you and your employees.

*HSBC will convert currency at our quoted daily rate and for our international payment costs (send/receive) see the Business Price List (PDF, 272KB)

**All loans and overdrafts are subject to status and application

Business Banking Account Features

Features of your account

- Online banking

- Live Chat

- Virtual assistant

- Mobile app

- Telephone banking

Convenient access

- Visa debit cards

- Cheque book on request

- Bank in branch or in over 11,500 Post Offices®

- Access cash services at various locations across the UK.

Support

- Dedicated Relationship Manager

- Specialist Support Teams

- Telephone support

Visit our find a branch banking page to find out the developments in additional cash access solutions.

Add-ons for flexibility as you grow

Credit & borrowing

- Commercial Card or Corporate Card (subject to status and application)

- Arranged overdraft (subject to status and application)

- Business loans (subject to status and application)

- Specialist financing solutions (subject to status and application)

International payments

- International payments from £17*

- Accounts in various foreign currencies are available on request

Additional banking platforms

🗸 HSBCnet1

Business Banking Account Rates and tariffs

First 12 months

Our introductory offer for start up and switchers | |

|---|---|

Monthly fee | Free |

Payments online (made via Business Internet Banking) | Free |

Debit card payment | Free |

Cash deposit in branch and Post Office® | Free |

Cheque deposit in branch and Post Office® | Free |

After 12 months

Move onto the Business Banking Tariff | |

|---|---|

Monthly fee | £10 |

Payments online (made via Business Internet Banking) | Free |

Debit card payment | Free |

Cash deposit in branch and Post Office® | 1.50% of value deposited |

Mobile cheque deposit | 50p per cheque |

Got questions?