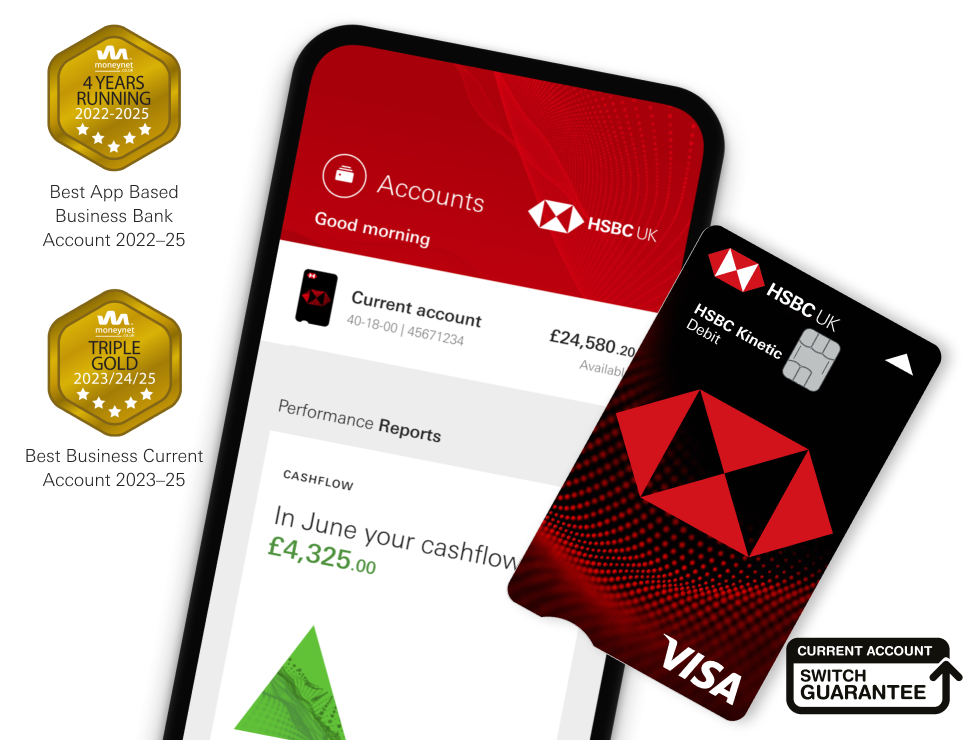

- No monthly account fee and free UK digital banking1

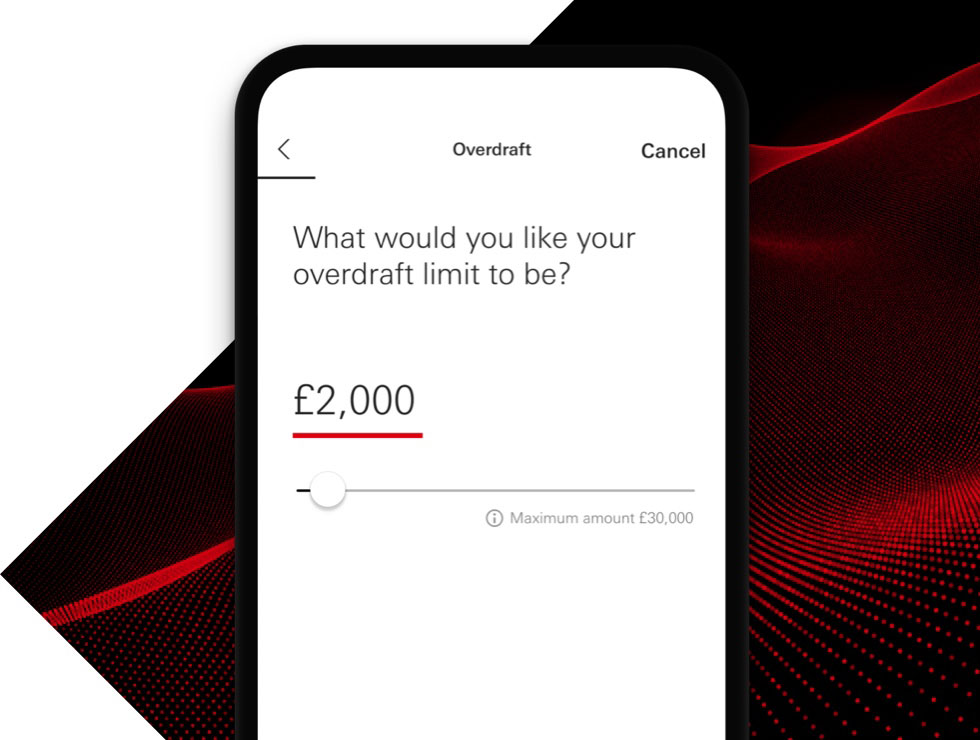

- Easy in-app application for an overdraft if you need funds2

- Monthly cashflow outlook and categorised spending tools

- Mobile cheque deposit

- Making payments of up to £25,000 per day in-app

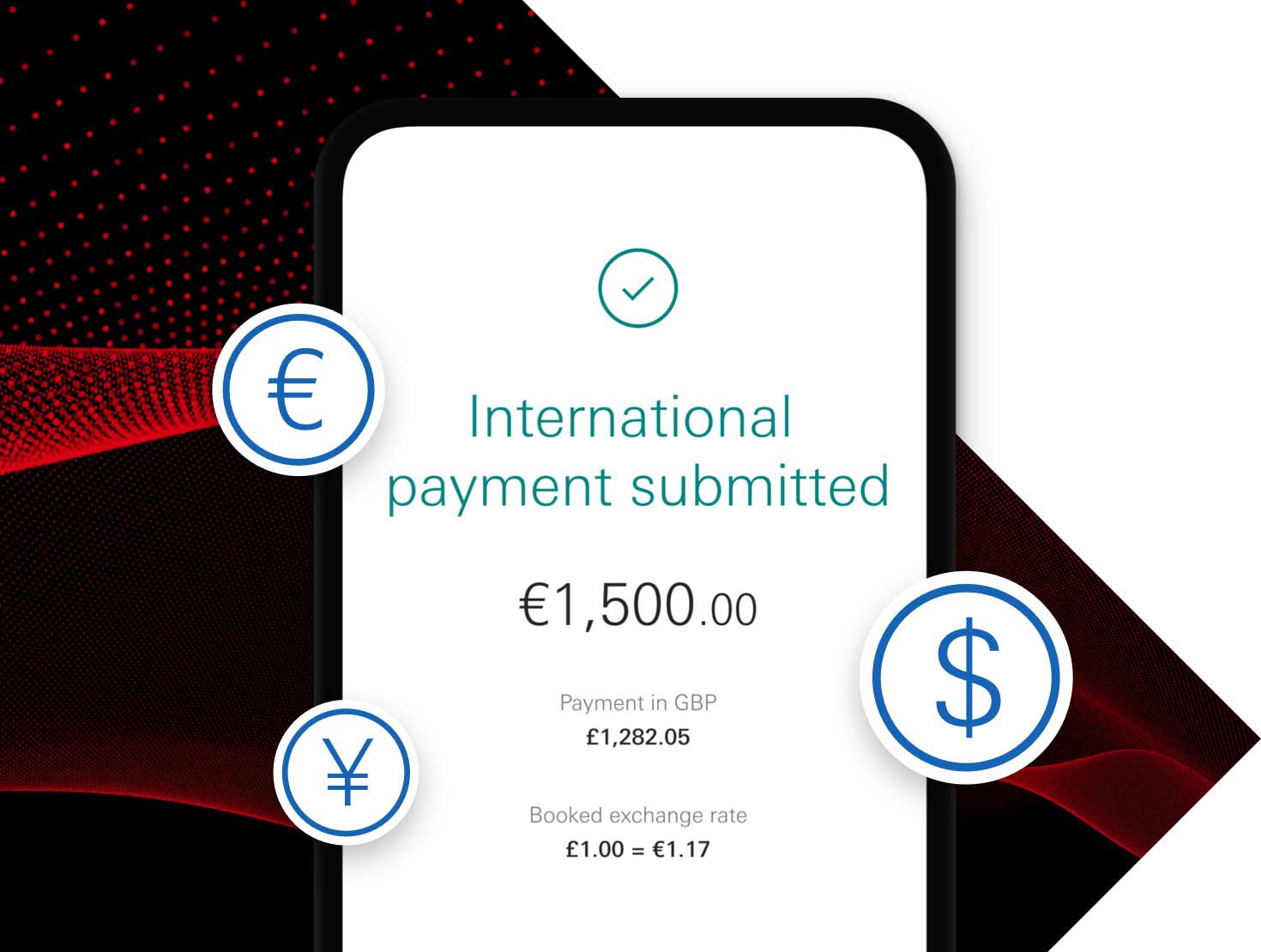

- International Payments to send and receive money to/from over 200 countries and territories (fees apply)