- 3 minutes

- Article

- Support

- Economic Reports

- Market Research

UK in Focus: The fastest growing economy in the G7?

Strong Q2 GDP growth masks weakness in the private sector, while uncertainty over the upcoming Autumn Budget could weigh on sentiment and activity. Despite a looser labour market and slowing pay growth, price rises have accelerated and been broad-based; that may warrant a pause in the BoE’s current cutting cycle.

The fastest growing economy in the G7

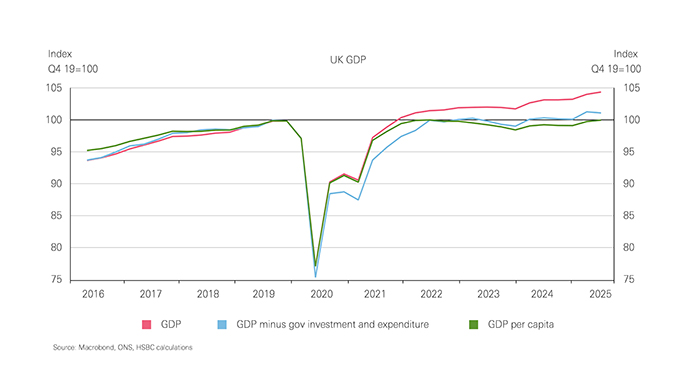

GDP data published in August, for the second quarter, was soft but a mixed bag. Strength in the government sector was partially offset by weakness in the private sector, where a 0.2% q-o-q contraction was reported. However, taken as a whole, economic growth in the first half of 2025 was robust relative to a backdrop of heightened global uncertainty, a large rise in labour costs, ‘Awful April’ for consumer prices, and a weakening jobs market.

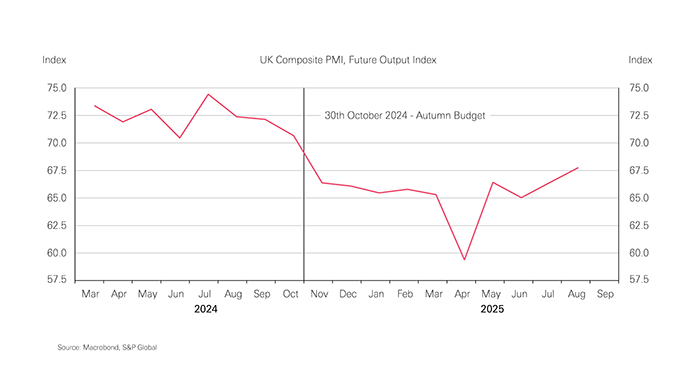

Some déjà vu in the third quarter

So far data for the third quarter has provided a little optimism on the activity front. UK PMIs point to an improvement in momentum relative to Q2, and consumer confidence ticked higher alongside stronger growth in consumer credit. There is the prospect that the second half of 2025 will look similar to that of 2024 as the UK government finds itself again in the midst of speculation that the Autumn Budget on 26 November will require a combination of higher borrowing, spending cuts, and tax increases. Indeed, markets, business and consumers alike have become more concerned over future growth, and UK borrowing costs have continued to rise.

Higher debt servicing costs, alongside reversals in planned spending cuts, and possible downgrades to growth forecasts all contribute to the erosion of fiscal headroom. How the Chancellor chooses to respond is more uncertain; we see a few possible scenarios, but the key decision will be whether the fiscal can is kicked down the road or is there the political courage to reset the public finances onto a more sustainable footing.

Looser labour markets are yet to weigh on inflation

Fiscal woes have seen yields on government debt, globally, rise sharply in 2025 but for the UK more specifically, sticky inflation is also a concern. Headline CPI rose to 3.8% y-o-y in July, driven by services and food prices. We think that headline CPI will top 4.0%, double the BoE inflation target, in the coming months. If price growth continues to be broad-based, that may warrant a pause in the BoE’s current one-rate-cut-per-quarter pace until there is greater certainty that price pressures have abated.

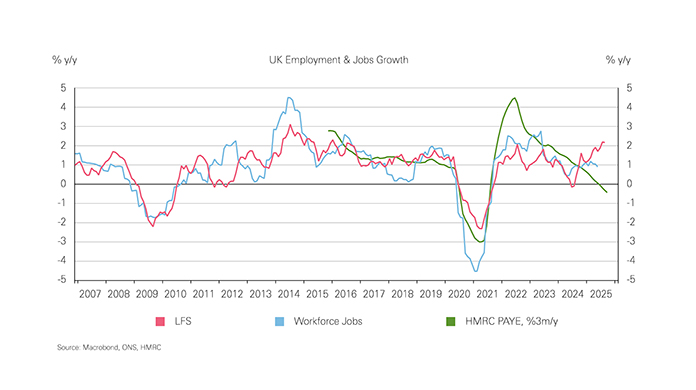

That will depend on labour market loosening translating into softer wage growth. The unemployment rate has risen to 4.7%, and we expect slack will continue to emerge. But, while employment intentions are subdued, official data point to continued growth in jobs; the lack of reliable employment data only adds to BoE cautiousness.

This report is a summary of previously published content. Any questions, please email

Analyst Certification

The following analyst(s), economist(s), or strategist(s) who is(are) primarily responsible for this report, including any analyst(s) whose name(s) appear(s) as author of an individual section or sections of the report and any analyst(s) named as the covering analyst(s) of a subsidiary company in a sum-of-the-parts valuation certifies(y) that the opinion(s) on the subject security(ies) or issuer(s), any views or forecasts expressed in the section(s) of which such individual(s)is(are) named as author(s), and any other views or forecasts expressed herein, including any views expressed on the back page of the research report, accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Emma Wilks.

Important disclosures

This document has been prepared and is being distributed by the Research Department of HSBC and is intended solely for the clients of HSBC and is not for publication to other persons, whether through the press or by other means.

This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Advice in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products.

The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments, both equity and debt (including derivatives) of companies covered in HSBC Research on a principal or agency basis or act as a market maker or liquidity provider in the securities/instruments mentioned in this report.

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking, sales & trading, and principal trading revenues.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research. HSBC Private Banking clients should contact their Relationship Manager for queries regarding other research reports. In order to find out more about the proprietary models used to produce this report, please contact the authoring analyst.

- This report is dated as at 03 September 2025.

- All market data included in this report are dated as at close 02 September 2025, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of

Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses

to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4 You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund