- 3 minutes

- Article

- Support

- Economic Reports

- Market Research

UK in Focus: Essential economic news for businesses

UK household and business sentiment ticked higher but not enough to change the fortunes of weak economic data for 2025. Meanwhile, slower inflation and an interest rate cut should support a further improvement in activity to start the new year but the 2026 outlook is fragile, with risks aplenty.

An 'it could have been worse' sentiment lift

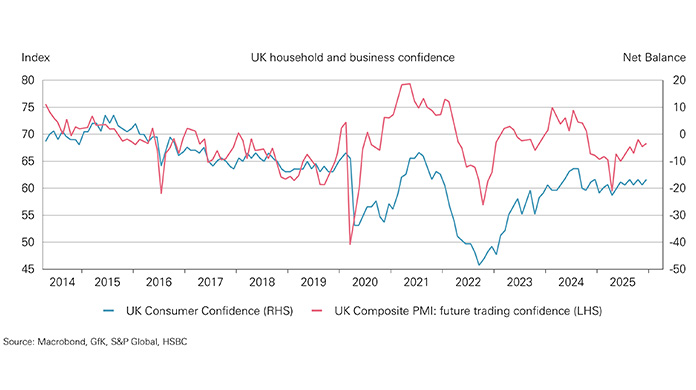

The UK spent much of the second half of 2025 worrying about possible tax rises in the Budget. Now, with worst-case scenarios largely avoided, and the Autumn Budget in the rear-view mirror, hopes turn to an improvement in sentiment and a pickup in economic growth. Early indicators for December showed a mildly more positive environment, consumer confidence rose to -17, up two points from November, but wasn’t enough to break out of its recent tight range. Similarly, the 0.6pt rise in the PMI business confidence in future trading expectations was modest given the degree of Budget related uncertainty.

More broadly, the economy has deteriorated: GDP growth was a meagre 0.1% q-o-q in Q3, real disposable income fell 0.8% q-o-q, the rate of unemployment rose to 5.1% in three months to October, and retail sales fell 0.1% m-o-m in November, suggesting a quieter-than-usual Black Friday. So, the small lift in sentiment in December is unlikely to translate into significantly better official data for that month or Q4 and reflects more of an ‘it could have been worse’ boost to sentiment.

Out with 2025, in with a new year

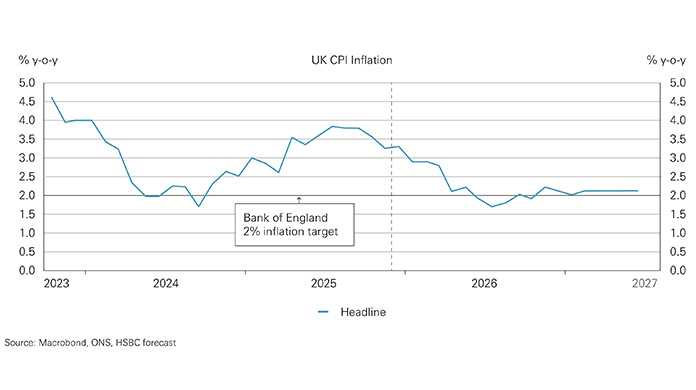

We remain relatively optimistic that Q1 2026 will prove better than the prior quarter. Indeed, there was some positivity that could provide a sound platform: UK inflation rate fell to 3.2% and the Chancellor’s Budget announcements should help see some sub-2% inflation rates in the middle of 2026. That improved inflation outlook coupled with the soft backdrop described above, helped see UK Bank Rate be cut to 3.75% at the BoE’s December policy meeting. In our view, interest rates will gradually fall further in 2026 which should enable a pickup in consumer spending and some more investment.

That said, our central case for 2026 is a fragile one, households remain cautious, real disposable income growth is meagre, and labour markets are soft. Unemployment could rise further amid subdued demand and further headwinds for businesses including labour costs and higher taxes. And although wage growth is slowing, a further above-inflation rise in the NLW in April combined with pockets of recruitment challenges risk the UK’s stagflationary environment persisting leading to a more uncertain interest rate outlook. We also need no more policy instability and yet one of the biggest risks to the outlook is political, namely the risk of a leadership challenge.

UK in Focus January PDF

Analyst Certification

The following analyst(s), economist(s), or strategist(s) who is(are) primarily responsible for this report, including any analyst(s) whose name(s) appear(s) as author of an individual section or sections of the report and any analyst(s) named as the covering analyst(s) of a subsidiary company in a sum-of-the-parts valuation certifies(y) that the opinion(s) on the subject security(ies) or issuer(s), any views or forecasts expressed in the section(s) of which such individual(s)is(are) named as author(s), and any other views or forecasts expressed herein, including any views expressed on the back page of the research report, accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Emma Wilks.

Important disclosures

Equities: Stock ratings and basis for financial analysis

HSBC and its affiliates, including the issuer of this report (“HSBC”) believes an investor's decision to buy or sell a stock should depend on individual circumstances such as the investor's existing holdings, risk tolerance and other considerations and that investors utilise various disciplines and investment horizons when making investment decisions. Ratings should not be used or relied on in isolation as investment advice. Different securities firms use a variety of ratings terms as well as different rating systems to describe their recommendations and therefore investors should carefully read the definitions of the ratings used in each research report. Further, investors should carefully read the entire research report and not infer its contents from the rating because research reports contain more complete information concerning the analysts' views and the basis for the rating.

From 23rd March 2015 HSBC has assigned ratings on the following basis:

The target price is based on the analyst’s assessment of the stock’s actual current value, although we expect it to take six to 12 months for the market price to reflect this. When the target price is more than 20% above the current share price, the stock will be classified as a Buy; when it is between 5% and 20% above the current share price, the stock may be classified as a Buy or a Hold; when it is between 5% below and 5% above the current share price, the stock will be classified as a Hold; when it is between 5% and 20% below the current share price, the stock may be classified as a Hold or a Reduce; and when it is more than 20% below the current share price, the stock will be classified as a Reduce.

Our ratings are re-calibrated against these bands at the time of any 'material change' (initiation or resumption of coverage, change in target price or estimates).

Upside/Downside is the percentage difference between the target price and the share price.

Prior to this date, HSBC’s rating structure was applied on the following basis:

For each stock we set a required rate of return calculated from the cost of equity for that stock’s domestic or, as appropriate, regional market established by our strategy team. The target price for a stock represented the value the analyst expected the stock to reach over our performance horizon. The performance horizon was 12 months. For a stock to be classified as Overweight, the potential return, which equals the percentage difference between the current share price and the target price, including the forecast dividend yield when indicated, had to exceed the required return by at least 5 percentage points over the succeeding 12

months (or 10 percentage points for a stock classified as Volatile*). For a stock to be classified as Underweight, the stock was expected to underperform its required return by at least 5 percentage points over the succeeding 12 months (or 10 percentage points for a stock classified as Volatile*). Stocks between these bands were classified as Neutral.

*A stock was classified as volatile if its historical volatility had exceeded 40%, if the stock had been listed for less than 12 months (unless it was in an industry or sector where volatility is low) or if the analyst expected significant volatility. However, stocks which we did not consider volatile may in fact also have behaved in such a way. Historical volatility was defined as the past month's average of the daily 365-day moving average volatilities. In order to avoid misleadingly frequent changes in rating, however, volatility had to move 2.5 percentage points past the 40% benchmark in either direction for a stock's status to change.

Rating distribution for long-term investment opportunities

As of 30 September 2025, the distribution of all independent ratings published by HSBC is as follows:

Buy 55% (13% of these provided with Investment Banking Services in the past 12 months)

Hold 38% (10% of these provided with Investment Banking Services in the past 12 months)

Sell 7% (6% of these provided with Investment Banking Services in the past 12 months)

For the purposes of the distribution above the following mapping structure is used during the transition from the previous to current rating models: under our previous model, Overweight = Buy, Neutral = Hold and Underweight = Sell; under our current model Buy = Buy, Hold = Hold and Reduce = Sell. For rating definitions under both models, please see “Stock ratings and basis for financial analysis” above.

For the distribution of non-independent ratings published by HSBC, please see the disclosure page available at http://www.hsbcnet.com/gbm/financial regulation/investment-recommendations-disclosures.

To view a list of all the independent fundamental ratings/recommendations disseminated by HSBC during the preceding 12-month period, and the location where we publish our quarterly distribution of non-fundamental recommendations (applicable to Fixed Income and Currencies research only), please use the following links to access the disclosure page:

Clients of HSBC Private Bank: www.research.privatebank.hsbc.com/Disclosures

All other clients: www.research.hsbc.com/A/Disclosures

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments, both equity and debt (including derivatives) of companies covered in HSBC Research on a principal or agency basis or act as a market maker or liquidity provider in the securities/instruments mentioned in this report.

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking, sales & trading, and principal trading revenues.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

Non-U.S. analysts may not be associated persons of HSBC Securities (USA) Inc, and therefore may not be subject to FINRA Rule 2241 or FINRA Rule 2242 restrictions on communications with the subject company, public appearances and trading

securities held by the analysts.

Economic sanctions laws imposed by certain jurisdictions such as the US, the EU, the UK, and others, may prohibit persons subject to those laws from making certain types of investments, including by transacting or dealing in securities of particular issuers, sectors, or regions. This report does not constitute advice in relation to any such laws and should not be construed as an inducement to transact in securities in breach of such laws.

For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research. HSBC Private Bank clients should contact their Relationship Manager for queries regarding other research reports. In order to find out more about the proprietary models used to produce this report, please contact the authoring analyst.

- This report is dated as at 06 January 2026.

- All market data included in this report are dated as at close 05 January 2026, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of

Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses

to ensure that any confidential and/or price sensitive information is handled in an appropriate manner. - You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund