- 3 minutes

- Article

- Support

- Economic Reports

- Market Research

UK in Focus: Finding signals through the fog

Labour market weakness continued at pace in April, but perhaps a tentative sign of improvement in May. Retail sales demand has picked up, but yet to see a translation into broader consumption. Higher than expected inflation complicates both monetary and fiscal policy.

It’s been a period of conflicting economic data releases for the UK economy, in part a reflection of the data being for the months either side and including April, which saw a lot of volatility and could prove a key inflection point for the UK economy.

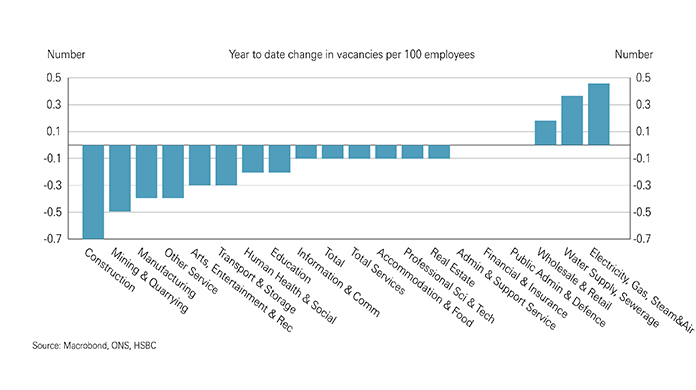

On the one hand, labour market indicators for April continued to show weakness in labour demand. PAYE employment fell 33k and, while that number will likely be revised, nearly every sector has reported a decline in vacancies since the start of the year (chart 1). Moreover, surveys pointed to a faster pace of headcount reductions and weaker demand for labour. And, although the labour market has been softening since 2022, the higher unit labour costs associated with a sharp rise in the national living wage and employer national insurance contributions hike provided further impetus. However, those factors came into effect in April and the PMI employment index was marginally improved in May, so labour market sentiment may, at least, be stabilising.

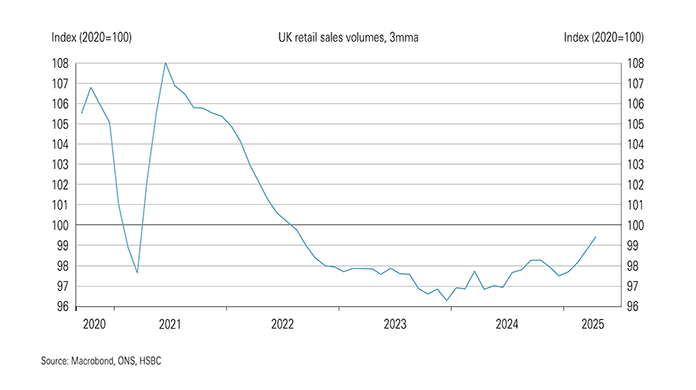

Despite weaker employment prospects, retail sales reported a fourth consecutive month of growth in April and a 5.0% rise y-o-y, its strongest pace of growth in three years. Some caution is needed in taking strong signals from retail sales as overall household consumption growth has struggled to find a footing amid continued rate pass through and cost of living increases. However, the upward trend in retail sales demand is in full swing (chart 2), forward-looking components of consumer confidence saw decent gains in May, and net household deposit growth has continued to slow to more historically normal rates.

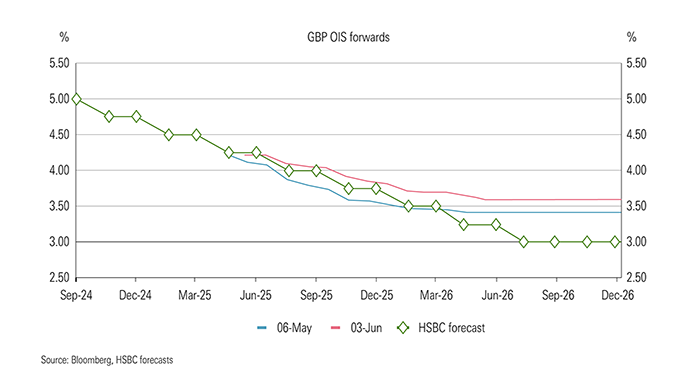

Inflation surprises make for policy conundrum

A plethora of known price rises in April and some surprise underlying price growth saw headline inflation accelerate to 3.5% y-o-y. More concerningly, services price inflation jumped to 5.4% y-o-y, higher than the BoE had forecast. Combined with still elevated wage growth, initial estimates from PAYE data point to wage growth of 6.4% y-o-y in April, which means greater uncertainty over the future path for rate cuts. Indeed, financial markets have pulled back expectations on rate cuts this year (chart 3). Longer-dated government bond yields have also continued to rise amid global uncertainty and a large risk premium associated with fiscal policy. That raises the risk of lower fiscal headroom in the autumn and a ‘doom loop’ for fiscal policy.

Analyst Certification

The following analyst(s), economist(s), or strategist(s) who is(are) primarily responsible for this report, including any analyst(s) whose name(s) appear(s) as author of an individual section or sections of the report and any analyst(s) named as the covering analyst(s) of a subsidiary company in a sum-of-the-parts valuation certifies(y) that the opinion(s) on the subject security(ies) or issuer(s), any views or forecasts expressed in the section(s) of which such individual(s)is(are) named as author(s), and any other views or forecasts expressed herein, including any views expressed on the back page of the research report, accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Emma Wilks.

Important disclosures

This document has been prepared and is being distributed by the Research Department of HSBC and is intended solely for the clients of HSBC and is not for publication to other persons, whether through the press or by other means.

This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Advice in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products.

The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments, both equity and debt (including derivatives) of companies covered in HSBC Research on a principal or agency basis or act as a market maker or liquidity provider in the securities/instruments mentioned in this report.

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking, sales & trading, and principal trading revenues.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research. HSBC Private Banking clients should contact their Relationship Manager for queries regarding other research reports. In order to find out more about the proprietary models used to produce this report, please contact the authoring analyst.

- This report is dated as at 03 June 2025.

- All market data included in this report are dated as at close 02 June 2025, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund