- 3 minutes

- Article

- Support

- Economic Reports

- Market Research

UK in Focus: Essential economic news for businesses

There are signs that demand is stabilising, but subdued consumer confidence points to a fragile outlook. Meanwhile, Bank Rate was left unchanged at 3.75%, and although further cuts are expected, the timing and scale of rate reductions is more uncertain.

Fragile with a hint of potential

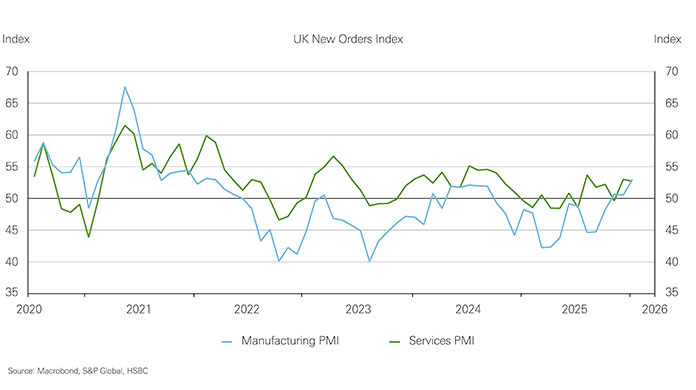

The year has started with mixed and volatile data, so it’s unclear how much underlying momentum in the economy has improved. Measures of business activity reported a sharp rebound in activity in January, most notably across services firms. However, consumer confidence ticked only 1pt higher, as improved confidence in personal finances was offset by lower expectations of the economy for this year. Those dynamics left consumers to continue to prefer saving. Elsewhere, there were signs that demand conditions are, at least, stabilising, house prices rose 0.3% m-o-m and manufacturers reported the fastest pace of new order growth since May 2022.

While the outlook is a fragile one, there is scope for a more marked improvement in demand. But we need to see a stable policy environment and a more sustained improvement in confidence to support underlying growth.

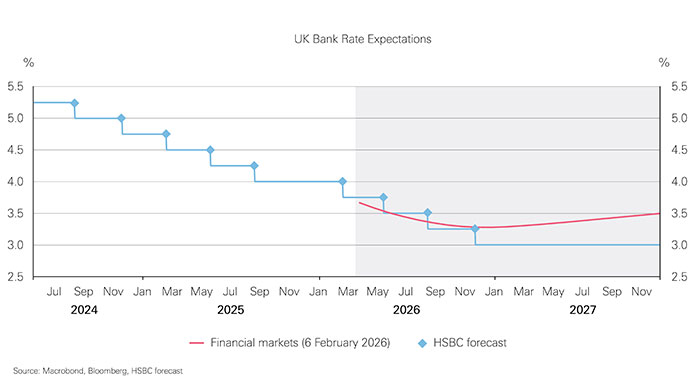

Bank of England hints at further rate cuts

At its latest policy meeting the Bank of England’s (BoE) Monetary Policy Committee left Bank Rate unchanged at 3.75%. Four of the nine-strong Committee voted for a cut, while more broadly, policymakers appear to be gaining confidence in the disinflationary process. The prospect of lower inflation reflects weak demand in the economy, a higher rate of unemployment, and policy measures announced at the Autumn Budget. Governor Andrew Bailey, who voted for unchanged rates this month, will be key in determining the timing of the next cut, given his relatively middle ground stance. Mr Bailey suggested that he needed to see a further falls in inflation expectations alongside the expected moderation in the current inflation rate. That would help to further alleviate concerns of upside risks to inflation over the medium term. It is widely expected that the CPI inflation rate will fall to around 2% in April 2026.

Then there is the question of how many more rate cuts are in prospect, and where Bank Rate may settle. That will be determined by how restrictive the Committee currently views interest rates to be on economic growth and inflation and whether any restrictiveness should remain in place for a more prolonged period. The latest BoE forecasts point to lower inflation, relative to its November forecast, and while the upside risks to inflation are judged to have diminished, they remain a source of uncertainty. Ultimately, after six rate cuts since August 2024, and with Bank Rate closer to its ‘neutral’ level, decisions on further rate cuts are likely to be finely balanced.

This content and much more is available for you on the Global Investment Research and Research App (App Store, Google Play). For research questions, please email: AskResearch@hsbc.com

UK in Focus February PDF

Analyst Certification

The following analyst(s), economist(s), or strategist(s) who is(are) primarily responsible for this report, including any analyst(s) whose name(s) appear(s) as author of an individual section or sections of the report and any analyst(s) named as the covering analyst(s) of a subsidiary company in a sum-of-the-parts valuation certifies(y) that the opinion(s) on the subject security(ies) or issuer(s), any views or forecasts expressed in the section(s) of which such individual(s)is(are) named as author(s), and any other views or forecasts expressed herein, including any views expressed on the back page of the research report, accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Emma Wilks.

Important disclosures

This document has been prepared and is being distributed by the Research Department of HSBC and is intended solely for the clients of HSBC and is not for publication to other persons, whether through the press or by other means.

This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Advice in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products.

The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments, both equity and debt (including derivatives) of companies covered in HSBC Research on a principal or agency basis or act as a market maker or liquidity provider in the securities/instruments mentioned in this report.

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking, sales & trading, and principal trading revenues.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research. HSBC Private Bank clients should contact their Relationship Manager for queries regarding other research reports. In order to find out more about the proprietary models used to produce this report, please contact the authoring analyst.

- This report is dated as at 10 February 2026.

- All market data included in this report are dated as at close 09 February 2026, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.