- 3 minutes

- Article

- Support

- Economic Reports

- Market Research

UK in Focus: Essential UK economic news for businesses

Fiscal spotlight continues to shine bright amid policy changes. Inflation and labour market data are on track to help deliver a BoE rate cut in August. Meanwhile, businesses and households are under considerable pressure.

One year on, fiscal challenges are still in the spotlight

The government has been in office for one year and while a lot has changed for the global and UK economies, the intense spotlight on UK public finances has not. The 12 June Spending Review highlighted the difficult trade-offs required against a backdrop of limited fiscal wriggle room. In order to keep commitments to boost funding for the NHS and raise defence spending to 2.6% of GDP by 2027, other departments are set to see real-term cuts from 2026-27.

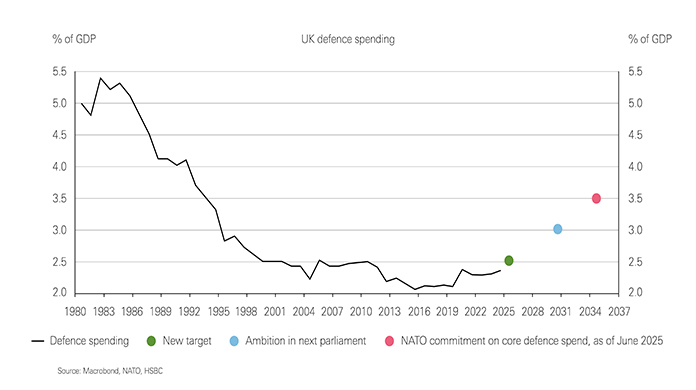

However, since then, spending commitments have continued to be announced. Alongside NATO allies, the UK has committed to raise defence spending to 5.0% of GDP by 2035. Within that, core defence expenditure has a 3.5% of GDP target at a cost of an additional GBP30bn a year by 2035 (chart 1), a headache for the next government. While 1.5% on “security and resilience” by 2027 would suggest that that funding will come from departmental budgets already set out at the Spending Review, rather than additional funds. Elsewhere, partial policy U-turns on welfare spending cuts and winter-fuel payments erode the small fiscal headroom ahead of the next Autumn Budget.

UK economy muddles through

At the latest Bank of England policy meeting in June, the committee voted to leave rates unchanged at 4.25%. The meeting minutes pointed to the need to see further progress in the disinflationary process for rate cuts to continue. Indeed, despite the recent acceleration in headline CPI to 3.4% y-o-y, it was in line with expectations and underlying inflationary pressures appear to have eased. Services inflation slowed, wage growth in April was slower than expected and labour markets continue to loosen. The rate of unemployment rose to a near four-year high in April, to 4.6%.

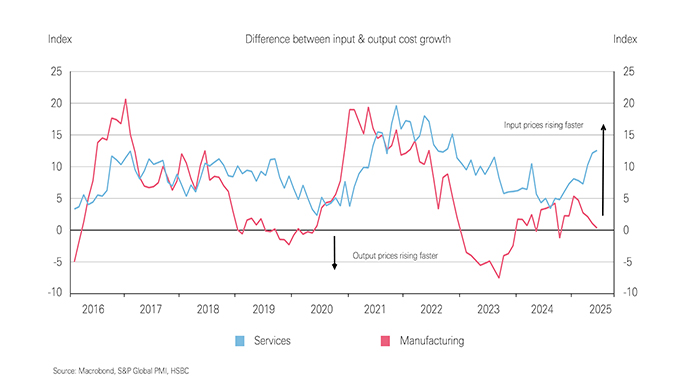

On the activity side GDP tumbled in April following a robust Q1 that was supported by unsustainable factors. For Q2, business surveys point to a muddling through in the face of a plethora of uncertainties, subdued demand and rising input costs. For services firms, the PMIs reported the greatest margin squeeze in over two years in June (chart 2). Similarly, renewed cost pressures on household budgets see reports of cutbacks, notably in food where price growth is reaccelerating. Meanwhile, the housing market, a bellwether of consumer sentiment, is yet to find any momentum after the hike in stamp duty, prolonged recovery in households budgets, and still restrictive interest rates. House price growth slowed to 2.1% y-o-y in June from 3.5% (chart 3).

This report is a summary of previously published content. Any questions, please email

Analyst Certification

The following analyst(s), economist(s), or strategist(s) who is(are) primarily responsible for this report, including any analyst(s) whose name(s) appear(s) as author of an individual section or sections of the report and any analyst(s) named as the covering analyst(s) of a subsidiary company in a sum-of-the-parts valuation certifies(y) that the opinion(s) on the subject security(ies) or issuer(s), any views or forecasts expressed in the section(s) of which such individual(s)is(are) named as author(s), and any other views or forecasts expressed herein, including any views expressed on the back page of the research report, accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Emma Wilks.

Important disclosures

This document has been prepared and is being distributed by the Research Department of HSBC and is intended solely for the clients of HSBC and is not for publication to other persons, whether through the press or by other means.

This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Advice in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products.

The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments, both equity and debt (including derivatives) of companies covered in HSBC Research on a principal or agency basis or act as a market maker or liquidity provider in the securities/instruments mentioned in this report.

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking, sales & trading, and principal trading revenues.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research. HSBC Private Banking clients should contact their Relationship Manager for queries regarding other research reports. In order to find out more about the proprietary models used to produce this report, please contact the authoring analyst.

- This report is dated as at 01 July 2025.

- All market data included in this report are dated as at close 30 June 2025, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.