Growing Your Business

Asset Based Lending (ABL)

Get in touch to discuss your Asset Based Lending needs

Contact usProvides flexible funding against the value of assets within your business via bespoke revolving lines of credit and/or term loans tailored to your needs.

At a glance – key product features

- Flexibility with revolving and term structures accommodated to maximise liquidity

- Funding levels linked to asset values

- Typically covenant-light and could provide greater funding levels compared to alternative solutions

- HSBC’s global reach enables cross border solutions

- Single facility agreement irrespective of the assets funded

Key benefits

Typically generates greater funding availability from unencumbered assets

Can support seasonal working capital needs, or strategic investments and acquisitions to deliver on your growth objectives

Funding grows dynamically as the value of your assets increases

Access to HSBC’s extensive working capital expertise and global presence. We’re in more than 50 countries and territories, with 5,000 trade professionals across the world

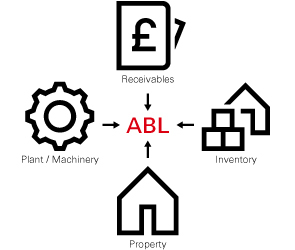

ABL structure – how it works

- Bespoke facility to meet your business needs based on the value of one or more of the following assets, on a revolving or term basis:

- Receivables – revolving

- Inventory – revolving

- Property – term

- Plant and Machinery - term or revolving

- Flexible Loan to Value (LTV) against each asset funded

- Funding regularly updated in line with asset growth

Is Asset Based Lending right for your business?

If any of the following apply to your business, this solution could meet your needs:

- Typically with turnover in excess of £50m and a funding requirement of £15m and above

- Selling on open account to other businesses in the UK or globally

- Asset heavy / capital intensive business wanting to maximise liquidity

- Increasing and / or seasonal working capital requirement

- Capital tied up in assets that could be working harder

- Looking for a flexible liquidity solution to support acquisition or expansion

Important information