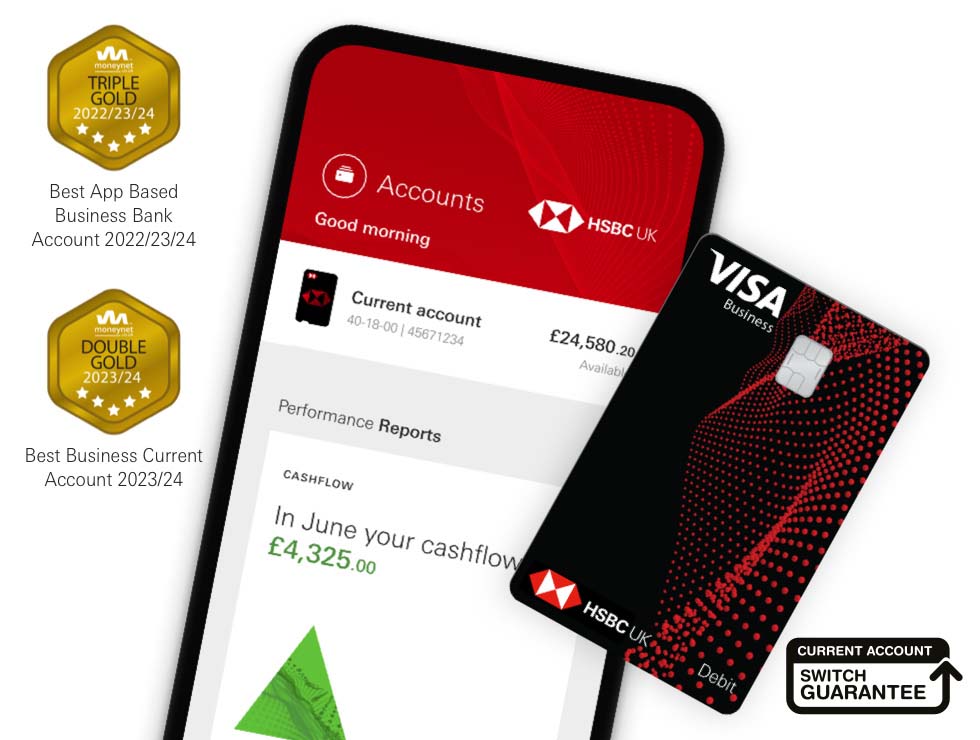

Explore our range of award winning accounts, from app based HSBC Kinetic for start-ups to accounts for established businesses that need a Relationship Manager.

Whatever your size, we’ve got a business account for you.

Explore our range of award winning accounts, from app based HSBC Kinetic for start-ups to accounts for established businesses that need a Relationship Manager.

Whatever your size, we’ve got a business account for you.

HSBC Kinetic Current Account is our award winning app-based business account, designed specifically with small businesses in mind. It makes business banking simpler and faster with most accounts opened within 48hrs.

If you require more complex everyday transactional banking services and multiple ways to access your business account, our Small Business Banking Account might be right for you.

Our Business Banking Account is designed for small and medium sized enterprises with established needs who require the support of a dedicated Relationship Manager and specialist teams.

*1 There is no monthly current account maintenance fee for 12 months from account opening date. The monthly current account maintenance fee after the fee free period is £6.50 per month. Fees subject to change, customers will be notified in advance. Other fees and charges apply, see pricelist for details. Subject to eligibility, credit check and terms and conditions.

*2 If you know your funding requirements are or will be more than £10k, this may not be the right solution for you at this time. Please find out more about the HSBC Kinetic lending products before applying.

*3 Free banking means no account maintenance fee and free standard transactions on your primary account, any additional or secondary accounts will be charged in line with the Small Business Banking Account.

Specialist banking services for Corporate Banking customers who generally have an annual turnover above £15m, typically trade internationally or require more complex lending structures. If you think you might qualify please contact us and we will assess your eligibility based on your needs