Grow your corporate business with HSBC UK

Looking to grow your business at home or internationally, we have relationship directors in your local area and industry specialists that can help.

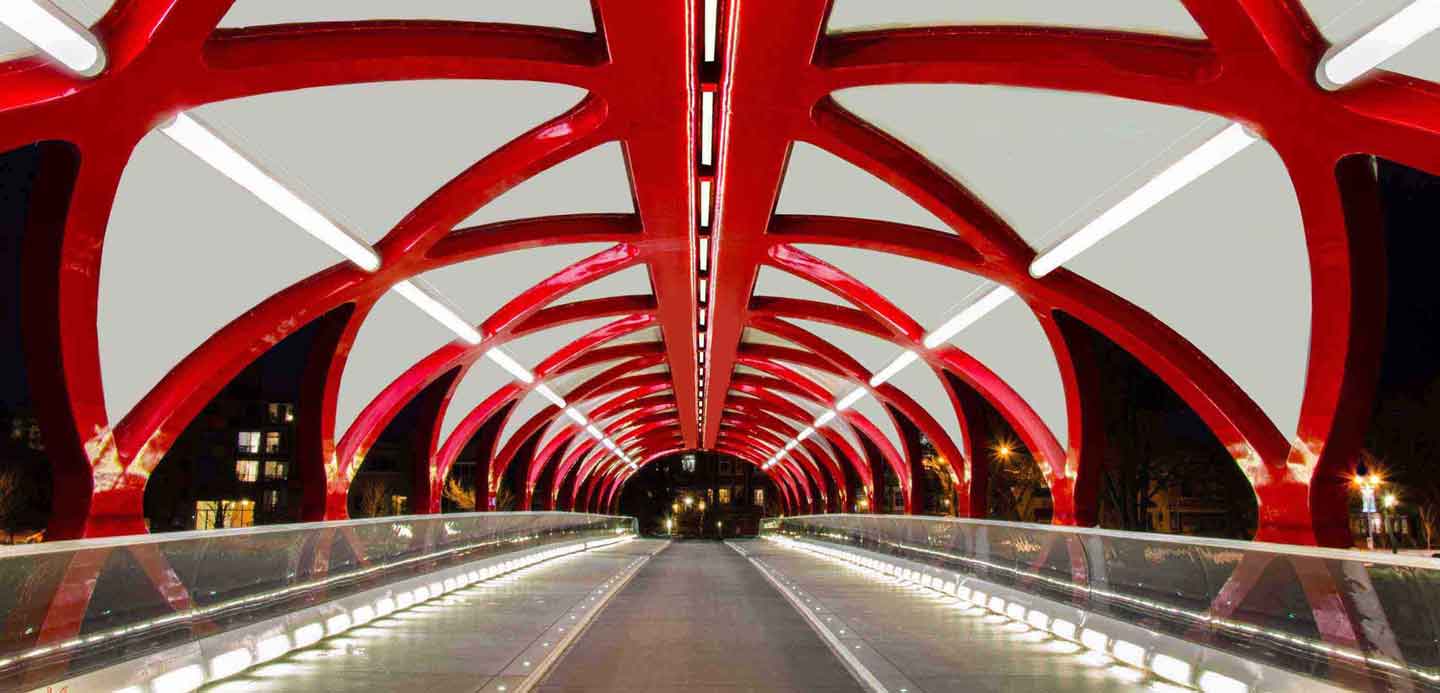

Where you find challenge, we’ll help you harness opportunity. With HSBC UK as your partner, doubts about exploring new markets becomes certainties. Obstacles like access to finance become strategic advantages. And ambitions to scale up or expand become reality.

With our specialist team, global reach and breadth of innovative solutions, we’re equipped and ready to connect you to the opportunities you need in order to reach your aspirations.

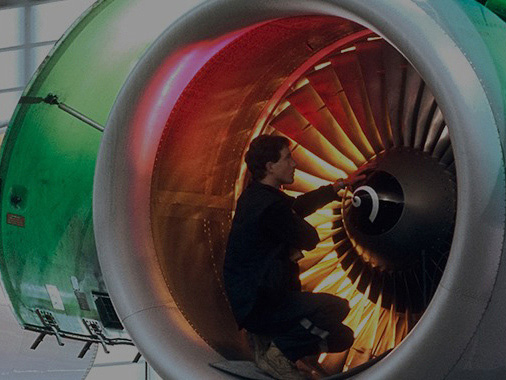

Our Sector teams bring diverse perspectives, technical expertise and a commitment to share best practice to help your business energise for growth.

We’re here to help you break down your business sustainability ambitions into achievable actions that can have an impact on your business. It all starts with a conversation.

Improve working capital by unlocking funds caught in the supply chain, and manage incoming and outgoing cash flows more effectively across your organization.

Inject capital into your supply chain, expand into new markets and improve your existing space and systems.

Streamline domestic and foreign payments and collections while also making the best use of cash balances.

Your eligible deposits held by a UK establishment of HSBC UK Bank plc are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme. This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc, HSBC Private Banking, and first direct. Any total deposits you hold above the limit between these brands are unlikely to be covered.

Please click here for further information or visit www.fscs.org.uk.