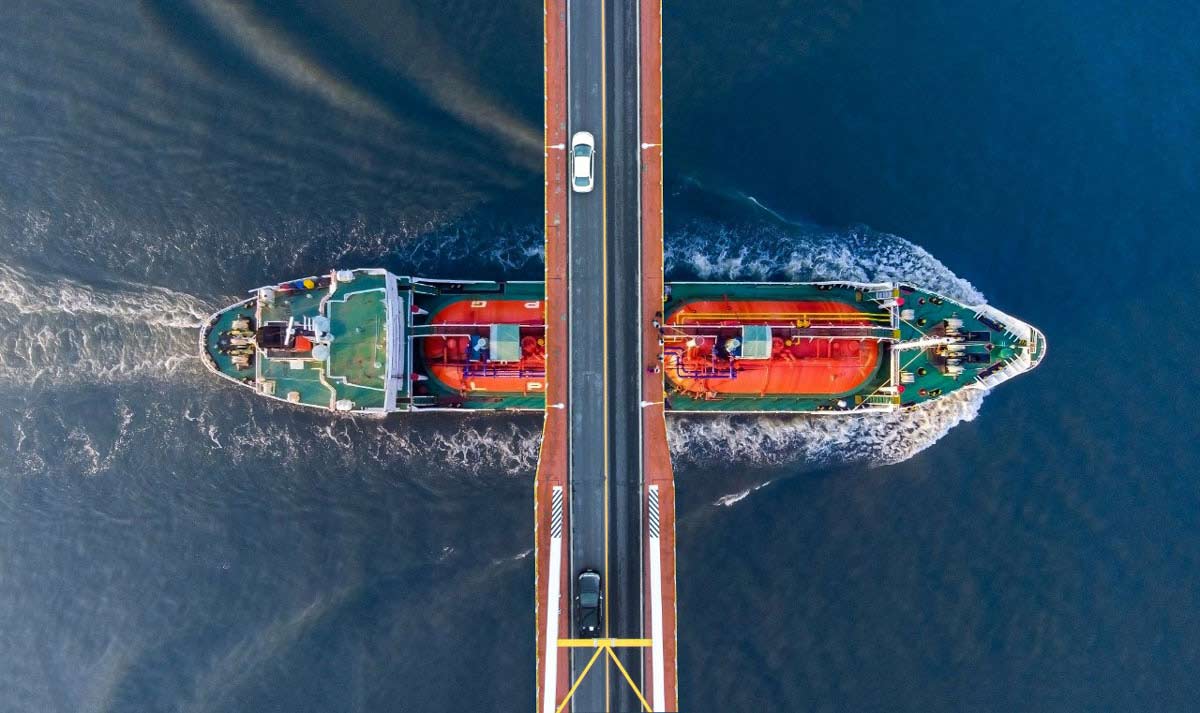

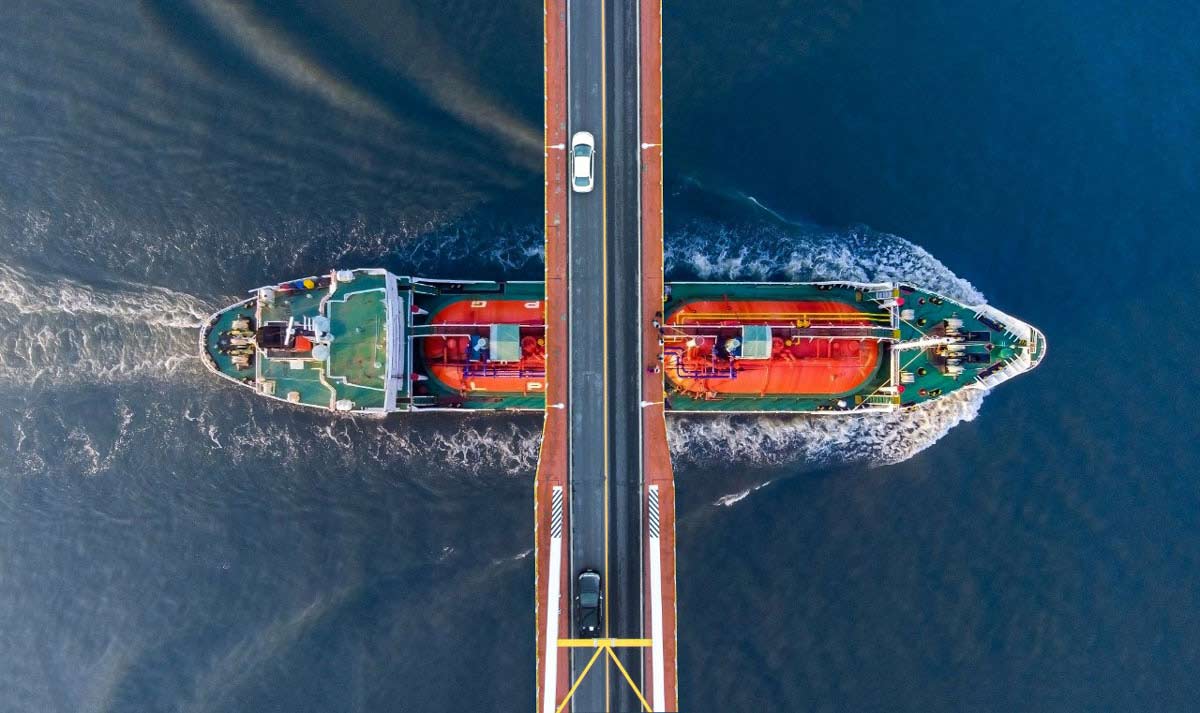

Trading Internationally

Imports

We understand the needs of importers. That’s why all our import services are designed to help you trade with assurance.

Our Import Collections service is a secure way to receive your goods, our Import Letter of Credit solution provides a trusted payment method so you can import with confidence and our import finance solutions allow you to pay your supplier promptly and negotiate better terms while improving your cash flow.

Import Letters of Credit

If you import goods, protect both yourself and your supplier with an Import Letter of Credit, a secure payment method for settling international trade transactions.

Import Collections

If you're looking for a secure and cost-effective way to trade with confidence, Import Collections let you pay your supplier after your goods have been shipped.

Buyer Loans

If you're importing goods, our Buyer Loans could help you improve cash flow, negotiate better terms with suppliers and pay them more promptly.

HSBC TradePay

If you're paying your suppliers by open account, HSBC TradePay lets you quickly and easily drawdown your loan and pay your suppliers, through a single seamless process.

Exports

If your business trades overseas, our international expertise could give you an advantage. With offices in markets worldwide, our Export Collections and Export Letter of Credit solutions could remove some of the risks associated with global payments. Our export finance solutions could give you access to the working capital you need to fulfil your orders and help you offer more favourable terms to your trading partners.

Export Letters of Credit

If you export goods, you can trade securely in the knowledge that you will receive payment - as long as you present documentation that satisfies the pre-agreed conditions.

Export Collections

Export Collections are a trusted and reliable method of getting paid for your exports, providing more security than dealing directly with your buyer.

Guarantees

Trading internationally without established relationships can feel like a leap of faith. That’s why we provide International Business Guarantees and Standby Letters of Credit, so that both parties can trade with increased security and reduced risk. With an extensive range of guarantees available, we can provide added support and security to meet your import and export needs.so that both parties can trade with increased security and reduced risk.

Guarantees

Trading internationally without established relationships can feel like a leap of faith. That’s why we provide International Business Guarantees and Standby Letters of Credit, so that both parties can trade with increased security and reduced risk.

International Business Guarantees

When you’re trading internationally with or without established relationships, our guarantees reduce trade risks by giving you and your supplier greater security

Business currency accounts

International Business Accounts

If you do business overseas, our choice of specialist account options could give you essential support in key areas such as importing and exporting, foreign currency and international payments.

Currency Client Account

If you hold money for clients in Euros or US Dollars, this flexible business account gives you instant access.

Making and receiving international payments

Whether your money is coming in or out, at home or abroad, we’ll handle it efficiently so that you can focus on running your business.

International payments

Whether you need to make one-off or regular international payments, you can send your money with confidence using our Priority Payments or SEPA Credit Transfer payment services.

Receiving international cheques

When your overseas trading partners pay by cheque, you can pay them into your account and access your money quickly using one of our processing services.

Clearing and foreign currency payments

Take advantage of our expertise and you'll be able to make and receive domestic and global payments with ease. We can help you send money abroad quickly, securely and cost-effectively via Electronic Funds Transfer (EFT) and Faster Payments.

Foreign exchange risk management

When doing business overseas, we believe it's important to protect profits from the risks that come with fluctuating foreign exchange rates.

Support

Import and Export Smartforms

Please ensure you are always using the most up to date version of the appropriate application form by downloading it directly from this page.

International Business Overdraft

If you want cash flow flexibility when transacting in international markets, our International Business Overdraft could be just the answer.