- 5 minutes

- Article

- Raising Finance

- Obtaining Funding

Going the extra mile for Orbital Education

When Orbital Education needed a lending facility, HSBC was able to look beyond its global structure and see the company’s competence and its opportunity for growth.

Orbital Education is not like most companies. It was founded in 2008 by Kevin McNeany, a recognised pioneer of British international education. McNeany founded Nord Anglia Education in 1972, a group that now has 70+ private day and boarding schools located in 30 countries across the Americas, Europe, China, Southeast Asia, India and the Middle East.

Orbital Education has similarities with the Nord Anglia model, which McNeany set up just before exiting his former business, offering high quality British curriculum education around the world. Orbital Education currently runs successful schools, spread globally from Latin America through Europe and the Middle East to Asia. The group educates over 5,000 young people from 114 nationalities and sends them on to high-quality universities.

The background

Orbital Education at its inception was funded entirely by McNeany personally, but as the group grew, it needed to source new funding to build and acquire new schools around the world. The group had been successful at attracting private equity funding, but Chief Financial Officer James Stewart wanted to find additional funding solutions allowing the company to maintain faster growth whilst continuing to respond nimbly and flexibly to opportunities. He also wanted to ensure that the company’s business structure was more transparent to future investors, so they could make funding decisions more easily.

“Ultimately, bank debt is less expensive than private equity funding and you don’t have to part with so much equity to secure it, therefore you can keep more of the proceeds and benefits of investments. Any company really needs a diverse set of options to extend financing,” he said.

The challenge

In late 2019, the company had been successful enough to pay back McNeany’s original investment, after which it embarked on securing bank financing as a next step.

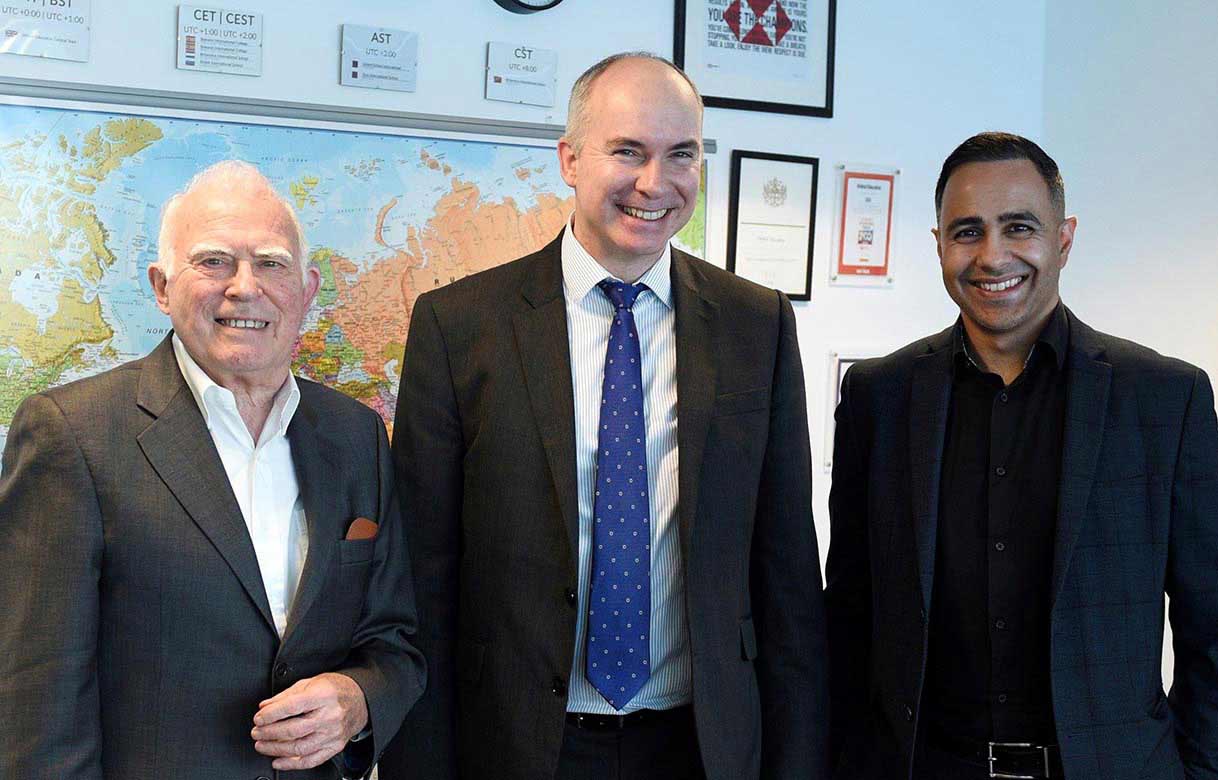

Zubayr Atcha, Global Relationship Director at HSBC UK, saw the potential in Orbital Education’s ambitious plans for growth but, given the global nature of Orbital Education, finding a funding solution took some time.

Orbital Education is headquartered in the UK and wanted to hold its debt there, but most of its profits are made overseas. The structure of the company was also quite atypical. It had adapted its model to each market it was operating in, so some of its subsidiaries were non-profits and other were for-profits. Typically, banks offer separate solutions for these two types of companies, as lending is based on profits from companies and on management contracts from not-for-profit organisations.

In some locations, Orbital Education works with partners, in others the company is the minority shareholder or simply holds an operating contract. Overall, the company had around 40 bank accounts and 30 entities in different countries.

“We don’t look like a Costa or a McDonald’s with the same structure replicated across geographies,” said Stewart. “We needed to work closely with HSBC to explain our structure and demonstrate how it works.”

Funding on a transaction-by-transaction basis was one possibility, but Stewart wanted to pursue a lending facility offering the funding the Orbital Education Group needs for its acquisition and growth plans, as well as demonstrating its viability to potential new investors in the future.

I could see we had a credible and experienced senior management team in a company and industry that had clear opportunities to grow. I was fully invested in finding a way to support them in what they wanted to achieve.

|

The solution

HSBC’s Atcha worked closely with Orbital Education’s senior management team over a number of years to refocus and refresh their growth strategy and demonstrate their ability to bring money back into the UK.

“We looked at different ways of repatriating the company’s profits and when we had successfully built a model, we had it checked by KPMG. They showed that the model followed OECD guidelines, was within the various regulatory jurisdictions and there was a demonstrable ability to sustain money coming back into the UK,” he explained.

The other challenge was the security for the lending. The majority of Orbital Education’s assets were owned overseas, which made it difficult for HSBC to use them as security.

“HSBC had to be creative about how they valued our assets and establishing if those values would be sufficient to cover the debt. Banks normally use standard covenants for lending, for example, stipulating that the lending can’t be more than three or four times a company’s UK profits. But because our earnings are mostly overseas, they had to do bespoke covenants,” said Stewart.

“With HSBC, it wasn’t an inflexible policy, the lending structure still had the robustness and strength that they needed, but it was creative and flexible to fit our group circumstances.”

This facility enables Orbital Education to tap into an additional finance channel to grow our portfolio faster, but it also provides the opportunity for others to invest in us. Our private equity partner can see that the bank is invested in us, which confirms their decision to invest. Other banks can look at us and say that if HSBC can do it, perhaps they can too. Other private equity firms may take a fresh look at us too.

|

The benefits

HSBC was able to put in place an eight-figure revolving credit facility which Orbital Education can use to develop international schools around the globe. The group is expecting to add thousands of new student places globally and expand its workforce in its UK headquarters with this significant investment.

“The interesting thing is that HSBC doesn’t just see this as a three-year facility. If Orbital Education uses the money well, HSBC will look at substantially increasing that facility in three years’ time. And if we’re still doing well after that facility, there may be a chance of bank syndication,” said Stewart.

Everything that HSBC and Orbital Education learned and put in place throughout this process is also available and relevant for future investors.

“This facility enables Orbital Education to tap into an additional finance channel to grow our portfolio faster, but it also provides the opportunity for others to invest in us. Our private equity partner can see that the bank is invested in us, which confirms their decision to invest. Other banks can look at us and see that if HSBC can do it, they can too. Other private equity firms may take a fresh look at us too.

“So it’s not just a stepping stone to other acquisitions for Orbital Education, it’s also the possibility of more financing.

Atcha had worked with Orbital Education for over four years to establish a structure that would work for the lending, but he counts it as some of the most rewarding work he has done.

“I’ve been told that most people would have accepted from the early stages that it was a difficult challenge,” he says. “But I could see we had a credible and experienced senior management team in a company and industry that had clear opportunities to grow. I was fully invested in finding a way to support them in what they wanted to achieve.”

Stewart added that Atcha’s work ethic and the support he had from senior managers at HSBC made all the difference.

“Not everyone is hungry to get their teeth into something that’s going to be a big learning experience, but we had Zubayr. He was tenacious and worked extraordinarily hard to make things happen. He’s a partner; when we show him a problem, he goes away and tries to find solutions,” he said.

Atcha’s tenaciousness was also supported by the wider HSBC community. Leo Jones, Head of Education at HSBC UK, said the bank was excited to help Orbital Education deliver on its growth strategy.

“We are always proud to help the education sector grow and thrive. We’re delighted to be supporting Orbital Education with its future ambitions,” he added.