Whatever stage you’re at in your bid to crack international markets, information is key. We’re here to empower you with the insights, tips and case studies you need to expand.

International Markets Insights

New to Exporting

When you’re thinking of exporting you need somewhere to begin. You may want to be inspired by stories of global growth, fresh prospects and new markets. Look no further. We tap into a wealth of expertise.

Established Exporter

Your business may have started to see the benefits of going global, but there’s still plenty of opportunities out there. Gather fresh insight and read about the international experiences of your peers.

Tools and Resources

To help you with your exporting journey, check out the below tools and resources.

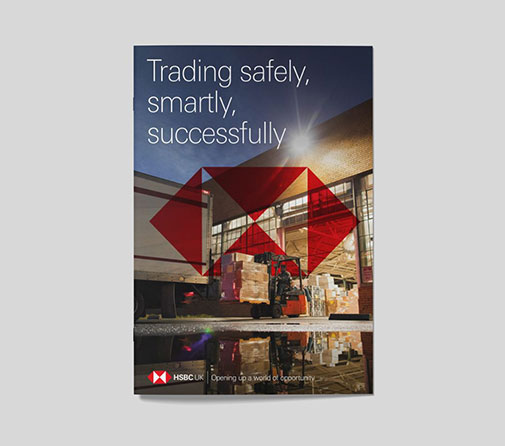

International Business Guides

The Exporting Journey

Exporting offers huge opportunities for businesses to reach new customers in new markets and spread their risk. Check out the Exporting Journey guide for tips

Made in the UK, sold to the world

Government advice and opportunities service for your overseas development.

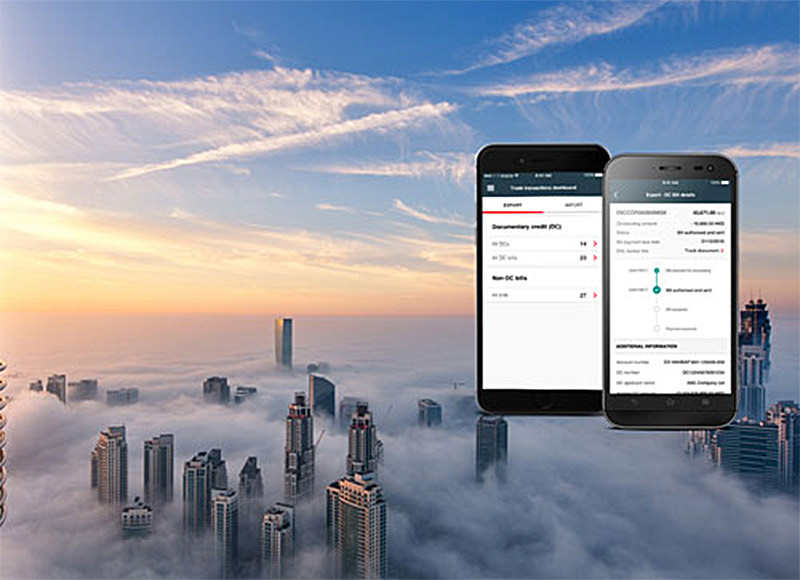

Trade Transaction Tracker

A quick and easy way to access your trade transactions…anytime, anywhere.

Insights Hub

Taking your business overseas - where should you start?

Exporting offers huge opportunities for businesses to reach new customers in new markets and spread their risk. From adapting your products to researching markets, we take you through the key steps to trading successfully overseas.

The 5 hows of exporting