Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own.

For more information visit www.hsbc.com/sustainability

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own.

For more information visit www.hsbc.com/sustainability

59%

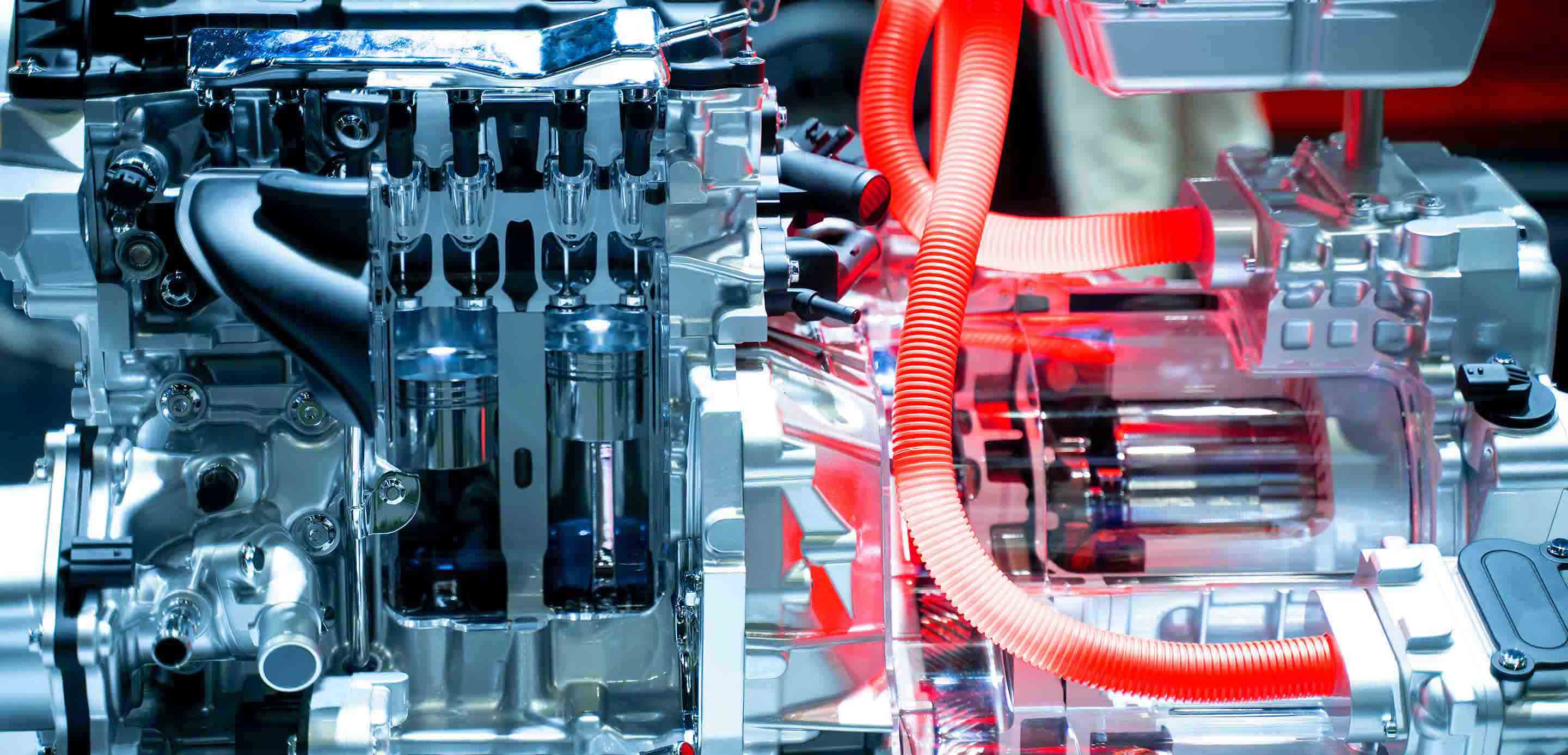

Businesses are overwhelmingly positive about the potential of technological change for their business. Over half believe it will have a positive impact

37%

Of firms are using capex funding to expand into new markets like North America, South-East Asia and the Middle East (rising to 65% for high-growth businesses)

35%

Of firms will increase spending on environmental sustainability

Without the right people, in the right roles, in the right location, businesses aren't sustainable and can't thrive – which makes the case for investment unquestionable.

|

We’re ready to support your capex plans for the future – talk to us today about your business priorities.

You may also be eligible for Asset Finance, which can help your business access the equipment, vehicles or technology it needs to grow. Our finance options allow you to avoid large, upfront payments, spread costs and manage your cashflow more effectively.