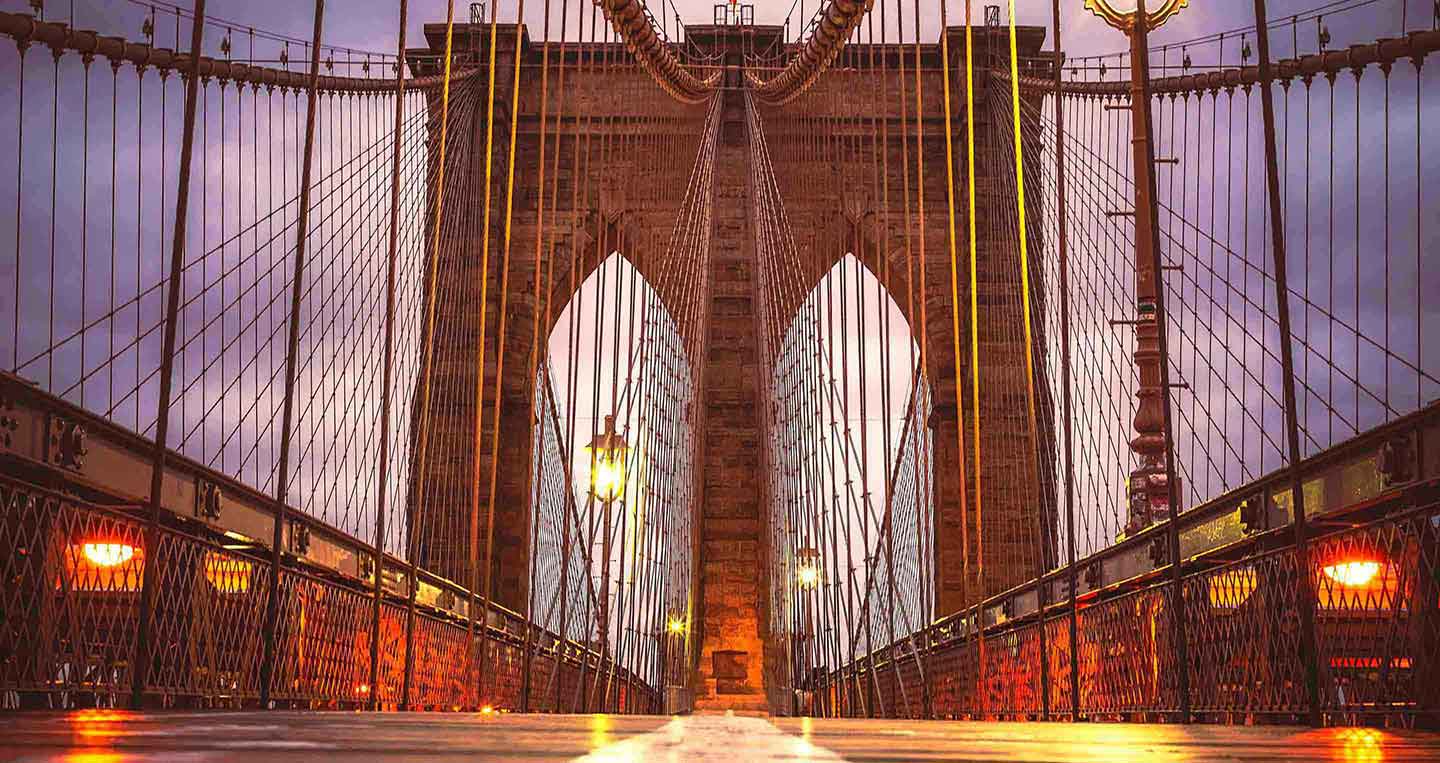

Manage business banking on the go at the touch of a button

HSBC Kinetic helps big-up the start-ups

Hear insights from small business owners who have kick-started and grown their business with HSBC Kinetic.

Empty stall? Or gap in the market?

Businesses who bank with us see things differently. However, your business grows, we’re the bank that can go with you.

We’re with you all the way

HSBC Kinetic makes business banking simpler and faster

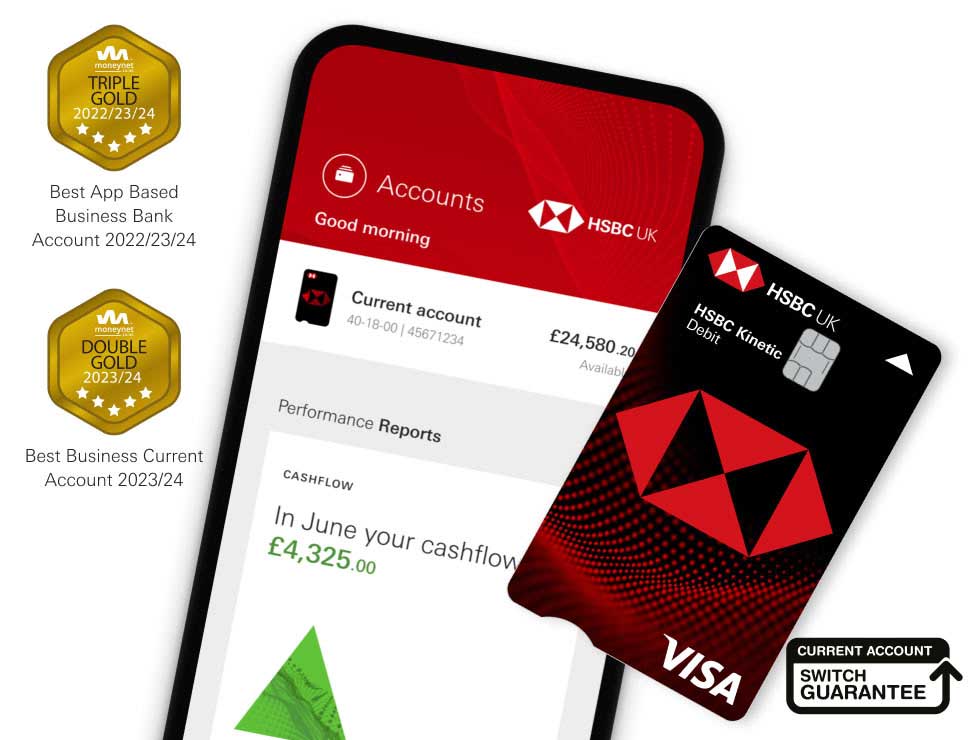

Award winning business banking

Euromoney Awards for Excellence 2023

Voted Best Bank for SMEs in the UK

Banking at the speed of business

Spend less time banking and more time growing your business.

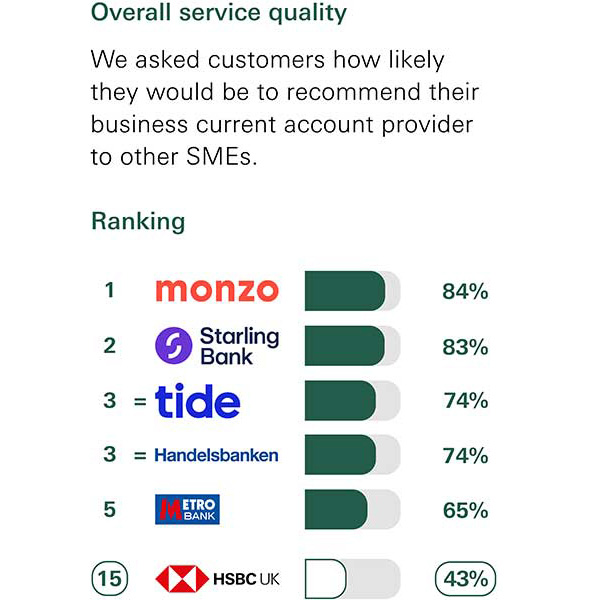

Independent service quality survey results

Overall service quality

An independent survey was conducted to ask UK customers of the 15 largest business current account providers, whether they would recommend their provider to other small and medium enterprises (SMEs).

We ask customers how likely they would be to recommend their business current account provided to other SMEs.