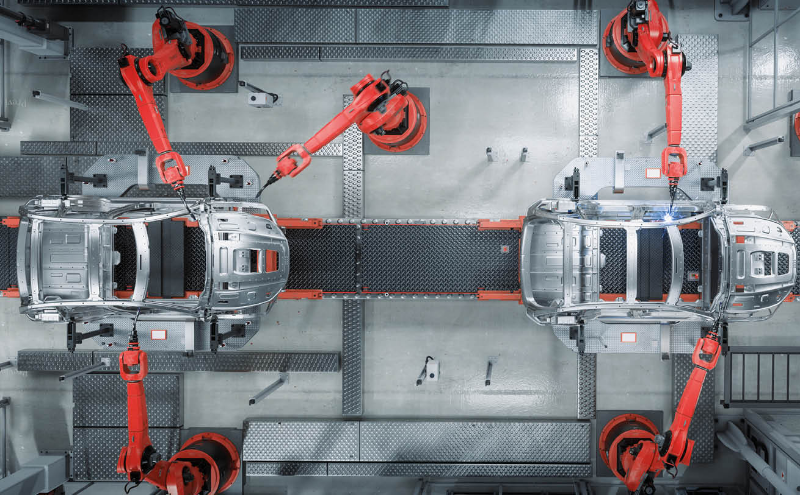

Asset Finance, also known as Equipment Finance, is available to businesses with an anticipated annual capex spend of typically £100k or more.

Complete a short form to find out whether it is right for you.

Structure your capital expenditure programme through Hire Purchase, Finance Lease, Operating Lease or Asset Loan

For commercial vehicles, IT hardware and software and for more complex asset finance requirements

Our team can offer guidance on how to use asset finance

Access the equipment you need to support your transition to net zero

Asset Finance, also known as Equipment Finance, is available to businesses with an anticipated annual capex spend of typically £100k or more.

Complete a short form to find out whether it is right for you.

This family business is on road to net zero with the first electric coach in the northeast, which is estimated to save 100,000 kg of Co2 per year. Coatham Coaches is already planning to buy a further four electric coaches by the end of 2024.

Deralam Laminates Limited is using CapEx investment to support the journey to net-zero, with a Biomass Boiler & Solar Panels enabling a more efficient and long-term low-cost carbon reducing solution.

Ivor King is harnessing the sun’s power by installing 374 solar panels across its facility in Nuneaton, set to create around 30 jobs. It is just one of their key steps in the journey to becoming even more sustainable as an organisation.

The Ocean Fish Group uses CapEx investment to modernise the company’s fishing fleet as well as boost growth, which is to create up to 50 full-time positions.

An energy intensive manufacturing business, Sigmatex made CapEx investment to reduce its carbon footprint and energy costs, whilst supporting employees with transition to net-zero through salary sacrifice employee benefit for electric vehicles (EVs).

The Green SME Fund is a key part of our commitment to support businesses of all sizes by helping them invest in sustainable solutions and transition and thrive in a low carbon economy.

Lending is subject to status eligibility criteria and T&C’s apply.

The Green Asset Finance product facilitates the financing of green assets through hire purchase, commercial loan, finance lease and operating lease.

Lending is subject to status.

Your Relationship Manager can advise you of the benefits and uses of Green Asset Finance.

From generating actionable recommendations, to helping you understand how you compare to similar businesses, our Sustainability Tracker can give you the tools to measure, plan, implement and track your sustainability progress.

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information click here.

Asset Finance is provided by HSBC Equipment Finance (UK) Ltd.

HSBC Equipment Finance (UK) Limited is a fully participating member of the Finance Leasing Association.

To help us continually improve our service and in the interests of security, we may monitor and/or record your telephone call with us.

Don't have Adobe PDF Reader? Download Adobe Reader

Standards of Lending Practice for Asset Finance Our lending principles

When you borrow from HSBC, you can be reassured that your business will be properly and fairly treated.

The Standards of Lending Practice sets out the principles of good practice in relation to lending to business customers with an annual turnover of up to £6.5m.

Link to the Standards for Business Customers - Asset Finance

Link to the Statement of Lender and Borrower Responsibilities

Call us for a quote on

Lines are open 9am to 5pm Monday to Friday, excluding public holidays